|

|

|

|

| ||||||||

|

||||||||

|

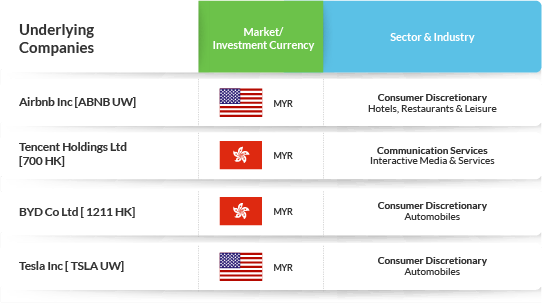

Hurry! Explore the opportunities to diversify your portfolio with the underlying companies below.*

|

||||||||

|

|

||||||||

|

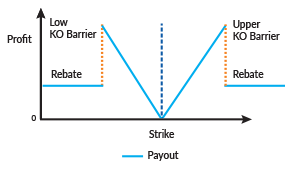

Shark Fin Structured Investment

|

||||||||

|

||||||||

|

|

||||||||

|

Auto-callable Equity-linked Investment

|

||||||||

|

||||||||

|

Watch a video on Auto-callable Equity-linked Investments here.

|

||||||||

|

|

||||||||

|

Contact your dedicated Relationship Manager today to find out more

|

||||||||

|

|

|

|

|