Structured investments: The secret weapon you’ve been looking for

If you’re a seasoned investor looking for a new way to diversify your portfolio and stay ahead of the pack, structured investments are the way to go. This article provides a brief overview of each type and how they can be applied.

So, you’re a seasoned investor, well-versed with the ins and outs of the market. You know the jargon; you walk the talk. Your portfolio is a textbook example of what a portfolio should look like. Instead of counting sheep before you sleep, you calculate your potential returns.

But there’s something missing. You’re looking for that one differentiating factor – the investment tool that combines the benefits of traditional investment options to create an almost super hybrid option. The

one ring to bring them all, and in the markets bind them. Well, Frodo, your search ends here.

Structured investments allow you to go beyond the limitations of traditional investment options, like a gateway to a whole new dimension of investment opportunities. They are financial instruments designed to meet specific investor needs by combining different components to create a customised product mix. These investments typically involve the use of derivatives and can include a combination of debt securities, equities, commodities, currencies, or interest rates. The combination of these components allows you, the investor, to express a particular market view, whether it is bullish, bearish, or market neutral.

Depending on your objectives and the market conditions, structured investments can offer principal protection, downside risk mitigation, enhanced yield opportunities, or exposure to specific asset classes. They can also incorporate features such as options, auto-callable features, or participation in index performance. Structured investments may be suitable for investors who are looking to customise their investment portfolios and potentially enhance returns within a defined risk profile.

There are several types of structured investments to choose from. However, with great power comes great responsibility. Each of these structured investments has unique characteristics, advantages, and risks associated with them. It's important to carefully consider your investment objectives, risk tolerance, and consult with a financial advisor before investing in any structured investment product. Use them wisely.

1. Quanto / Auto-Callable Structured Investments

Quanto / Auto-callable structured investments combine two features: a quanto option and an auto-callable feature. A quanto option is a derivative that allows investors to hedge against currency exchange rate fluctuations while gaining exposure to a foreign underlying asset. The auto-callable feature provides predetermined dates where, if specific conditions are met, the investment is automatically redeemed.

Quanto / Auto-callable structured investments offer potential returns and the possibility of early redemption, providing investors with the

opportunity to achieve above-market returns based on the performance of the underlying asset. However, they also carry certain risks, such as the possibility of not being able to participate in further upside potential if the investment is redeemed early.

Click

here for a better understanding on how auto-callables work.

When do we invest into this?

Market view: Mildly bullish

Risk tolerance: You can take some capital risk

Example scenario: You’re fairly confident in the underlying company shares and feel that a recession is not on the cards.

2. Twin Win Structured Investments

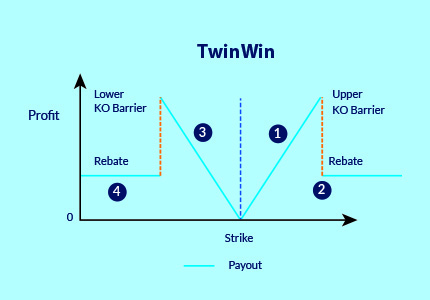

Twin Win structured investments are designed to offer enhanced returns in uncertain market conditions. The name "Twin Win" shows that investors can get potential returns regardless of which direction of the underlying asset performance heads in.

These structured investments offer principal protection with a

guaranteed minimum return at maturity.

Outcome 1: Upon maturity, the underlying asset performed but did not hit the upper knock-out barrier (observation closing price above the strike price but below the upper knock-out). The investor will receive their initial investment amount and the return of performance of the underlying asset.

Outcome 2: Upon maturity, the underlying asset performed and hit the upper knock-out barrier (observation closing price above the upper knock-out). The investor will receive the initial investment amount and the return of the pre-agreed rebate %.

Outcome 3: Upon maturity, the underlying asset under-performed but did not hit the lower knock-out barrier (observation closing price below the strike price but above lower knock-out). Investor will get the initial investment amount and the absolute return of the performance of the underlying asset.

Outcome 4: Upon maturity, the underlying asset under-performed and hit the lower knock-out barrier (observation closing price below the lower knock-out). Investor will get the initial investment amount and the return of the pre-agreed rebate %.