Ethical, equitable, and enduring: Make your wealth do MORE

In this article, we delve into the intricacies of a unique approach to wealth management that also contributes positively to society.

These days, we’re more conscious of how our money is made. Where does it come from? Who does it impact? What can we change with it? Accountability and transparency have become key factors in decision-making, and this affects us as regular folks trying to build a path to financial independence.

Let’s look at how wealth is built, in the conventional sense. The “traditional” approach relies on the free market to self-regulate supply and demand. We see this in how the prices of goods are determined. The businesses that supply these goods are motivated solely by profit, and the consumer is none the wiser. It was assumed that self-interest would lead to the best outcomes for society, whether intended or not. An example would be a business that produces a popular product would hire more people, therefore leading to economic growth for the community.

While that sounds wonderful on paper, it’s simply not sustainable. This form of excessive capitalism does not fully address social inequities, environmental degradation, and financial risk. These shortcomings opened discussions about the need for ethical considerations and regulations within the mainstream capitalist system. The investing world looked for alternatives and found a ready-made one.

The “safer” alternative for all

Islamic finance has been in existed for over 1,400 years, but the version we know today traces its roots to the 1970s, during the oil boom in the Middle East. Demand for Shariah-compliant products grew as the Middle East increased its global presence.

The true litmus test for Islamic finance came a little later, during the 2007-2008 global financial crisis. Islamic banks were less affected, as the principles of Islamic finance prohibit excessive risk-taking and speculation, two major contributing factors to the crisis. The industry’s proven resilience led to a growth in popularity among Muslims and non-Muslims alike.

Today, its alignment with Environmental, Social, and Governance (ESG) criteria has attracted an even broader audience. In short, anyone, regardless of religious belief, can benefit from the features of Islamic financial products.

Islamic finance has also become more popular in regions like Sub-Saharan Africa, Central Asia, and Europe, where governments and financial institutions recognise its potential to attract investment and promote financial inclusion.

The Key Principles of Islamic Wealth Management

Islamic Wealth Management (IWM) is a comprehensive approach to managing wealth based on Islamic finance. IWM encompasses the entire lifecycle of wealth, from creation and protection to purification and distribution. Islamic finance’s emphasis on fairness, ethical behaviour, and risk-sharing creates a more equitable financial system compared to conventional finance, which focuses primarily on profit and interest-based lending. By ensuring that economic activities align with social and ethical values, Islamic finance offers a unique approach to wealth management that appeals not only to Muslims but also to individuals seeking ethical and socially responsible financial solutions.

Here, we illustrate the key differences between the two approaches to wealth management.

Applying IWM to Your Wealth Journey

As mentioned earlier, there are four stages to the IWM journey: creation, protection, purification, and distribution. Here’s how IWM, rooted in the principles listed above, is applied through products that are accessible to all.

- Wealth Creation: In IWM, wealth creation refers to the process of generating income and growing assets in ways that align with Shariah principles. Wealth creation in this context is not just about individual financial growth but also about fostering a positive social impact, promoting justice, and benefiting the wider community, with an emphasis on sustainable, ethical investments that contribute to overall societal wellbeing.

RHB Islamic offers a diverse range of unit trust funds, structured investments, and sukuk that comply with Shariah principles, allowing you to grow your wealth ethically. Savings and Current Accounts-i offer profit-sharing opportunities while adhering to Islamic banking standards.

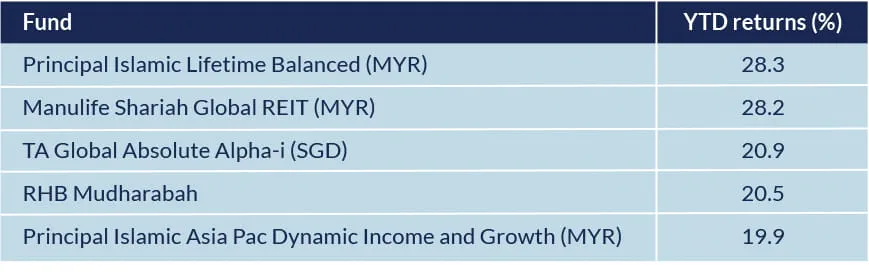

Top 5 Performing Islamic Unit Trust Funds (23 October 2024)

Source: Lipper Investment Management (23 October 2024) - Wealth Protection: Conventional insurance covers policyholder risks in exchange for premiums. It makes money by managing claims effectively and investing premium funds to ensure financial stability and provide value to policyholders. Takaful, on the other hand, is based on mutual cooperation and shared responsibility. Participants pool resources to support each other in case of loss or damage. Any surplus is distributed among members or donated to charity. This mutual risk-sharing promotes social solidarity.

In collaboration with Takaful providers, RHB Islamic offers solutions that protect against unforeseen events, ensuring financial stability for individuals and families. -

Wealth Purification: This is the process of cleansing one's income and assets to ensure they are fully compliant with Shariah principles. There are two ways to achieve this, first through zakat, which is a mandatory contribution for those who are able, and sadaqah, which is an additional voluntary donation of any amount for the purpose of benefiting the community, or even individuals in need. Wealth purification is not only about following religious obligations but also about ensuring that one's financial growth contributes to social welfare and economic justice.

RHB Islamic facilitates the calculation and distribution of zakat, making it seamless for investors. For sadaqah or contribution to charity, we have partnered with more than 40 charitable organisations. -

Wealth Distribution: In IWM, wealth distribution is the process of allocating one’s assets according to Islamic principles to ensure fair, ethical, and just inheritance and financial transfer after death. This distribution aligns with Shariah guidelines, which emphasise providing for family members and protecting social justice.

A Wasiat (Islamic will) serves as a document that enables one to specify the distribution of up to one-third of their assets upon death, while the remaining two-thirds must be distributed according to Faraid (Islamic inheritance law).

A Waqf is a Shariah-compliant alternative to a conventional trust, in which an individual (the donor) endows assets or properties for charitable or socially beneficial purposes. The assets in a Waqf are typically permanent and cannot be sold, inherited, or transferred, providing a lasting benefit to society according to Islamic principles. For example, a donor may wish to provide a plot of land for the purpose of building a school or a research centre. The assets in a Waqf are managed by a trustee (Mutawalli) who ensures that they are used according to the donor’s wishes.

At RHB Islamic, our experienced partners provide comprehensive assistance and guidance in creating an estate plan, ensuring your needs are met and your legacy is distributed effectively.

Do More With Your Wealth Today

If IWM appeals to your financial goals, RHB Islamic can help you build and enhance your wealth with Shariah-compliant retail products for every step of your journey to financial (and spiritual) fulfilment. Drop by any RHB branch to get started!

Member of PIDM. Terms and conditions apply. For further details on the benefits and exclusion of the product, please refer to the Product Disclosure Sheet (PDS) and Letter of Offer (LOA).

Disclaimer:

This article has been prepared by RHB and is solely for your information only. This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank Sdn Bhd (“RHB”). In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this article without first independently verifying its contents.

The information contained herein is strictly meant to be as general information and does not constitute a contract of insurance/takaful. Buying a life insurance/takaful policy is a long-term financial commitment. You must choose the type of policy that best suits your personal circumstances. You should read and understand the insurance/takaful policy and discuss it with the bank staff or contact the insurance/takaful company directly for more information. Investment-linked Plan is an insurance/takaful product that is tied to the performance of the underlying assets and is not a pure investment product such as unit trusts. You must evaluate your options carefully and satisfy yourself that the investment-linked fund(s) chosen can meet your risk appetite, and that you can afford the premium/contribution throughout the policy duration. Return on an investment fund is not guaranteed. For further details on the benefits, exclusions, and terms and conditions of the product, please refer to the Product Brochure, Sales Illustration, Product Disclosure Sheet (PDS), and policy contract. Underwritten by Syarikat Takaful Malaysia Keluarga Berhad 198401019089 (131646-K), RHB Bank is merely acting as a distributor.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this article and are subject to change without notice. It does not constitute an offer or solicitation to deal in units of any RHB fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for him. Past performance of the fund or the manager, and any economic and market trends or forecast, are not necessarily indicative of the future or likely performance of the fund or the manager. Investors are advised to read and understand content of the relevant documents including but not limited to prospectus or information memorandum that has been registered with Securities Commission and Product Highlight Sheet before investing. Investors should also consider all fees and charges involved before investing. Prices of units and income distribution, if any, may go down as well as up; where past performance is no guarantee of future performance. Units will be issued upon receipt of the registration form referred to and accompanying the Prospectus. The printed copy of prospectus and Product Highlight Sheet is available at RHB branches/Premier Centre and investors have the right to request for a Product Highlight Sheet.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the Principal Islamic Lifetime Balanced Fund dated 19 January 2024, Manulife Shariah Global REIT Fund dated 23 February 2024, TA Global Absolute Alpha-i Fund dated 18 October 2024, RHB Mudharabah Fund dated 30 April 2024, and Principal Islamic Asia Pacific Dynamic Income and Growth Fund dated 13 March 2024. (“Fund”) is available and investors have the right to request for a PHS.

The Manager wishes to highlight the specific risks of the Principal Islamic Lifetime Balanced Fund are Stock Specific Risk, Risks associated with Investment in Shariah-compliant Warrants and/or Islamic Options, Interest Rate Risk, Risk associated with Investing in Islamic CIS, Country Risk, Currency Risk, Risk of Investing in Emerging Markets, and Credit and Default Risk. The specific risks of Manulife Shariah Global REIT Fund are Manager’s Risk, Market Risk, Liquidity Risk, Financing Risk, Suspension/Deferment of Redemption Risk, Fund Manager Risk, Stock Specific Risk, Country Risk, Currency Risk, Risk Considerations for Investing in Islamic Hedging Instruments, Risk Associated with Investment in REITs, Reclassification of Shariah Status Risk and Taxation Risk/Withholding Tax Risk. The specific risks of the TA Global Absolute Alpha-i Fund are External Investment Manager’s Risk, Shariah Non-Compliance Risk, Shariah Status Reclassification Risk, Profit Rate Risk, Islamic Collective Investment Scheme Risk, Shariah-Compliant Equity Risk, Shariah-Compliant Equity Related Securities Risk, Islamic Financial Derivative Instruments (Islamic FDI) Risk, Currency Risk, Country Risk, Liquidity Risk, Concentration Risk, Counterparty Risk, and Distribution Out of Capital Risk. The specific risks of RHB Mudharabah Fund are Stock Market Risk, Individual Stock Risk, Liquidity Risk, Issuer Risk, Interest Rate Risk, Credit and Default Risk, and Shariah Specific Risk. The specific risks of Principal Islamic Asia Pacific Dynamic Income and Growth Fund are Currency Risk, Target Fund Manager Risk, Country Risk, and other general risks are elaborated in the Information Memorandum.

This article has not been reviewed by the Securities Commission Malaysia (SC).

RHB Bank Berhad 196501000373 (6171-M) | RHB Islamic Bank Berhad 200501003283 (680329-V)