Positioning for rate cuts in 2024

In our quarterly Fund Discovery Series, we discuss current market conditions and offer suggestions and strategies to diversify your portfolio.

Listen and subscribe to the podcast version by RHB Bank’s Head of Investors Advisory Nova Lui here to stay updated on the latest market developments.

Happy new year! Before we plan our steps for Q1, let’s have a quick recap of what happened in the global market in Q4 2023.

The continued instability in China and geopolitical tensions in the Middle East placed pressure on global economic growth. The fourth quarter of 2023 started off on a slow burn, with mixed view on the Fed’s monetary policy stance. However, soon after the expectations of a peak in the rate hike and market starts to price in prospect of multiple rate cuts in 2024, asset and portfolio values rose, closing most market higher with exception of the Chinese equity market.

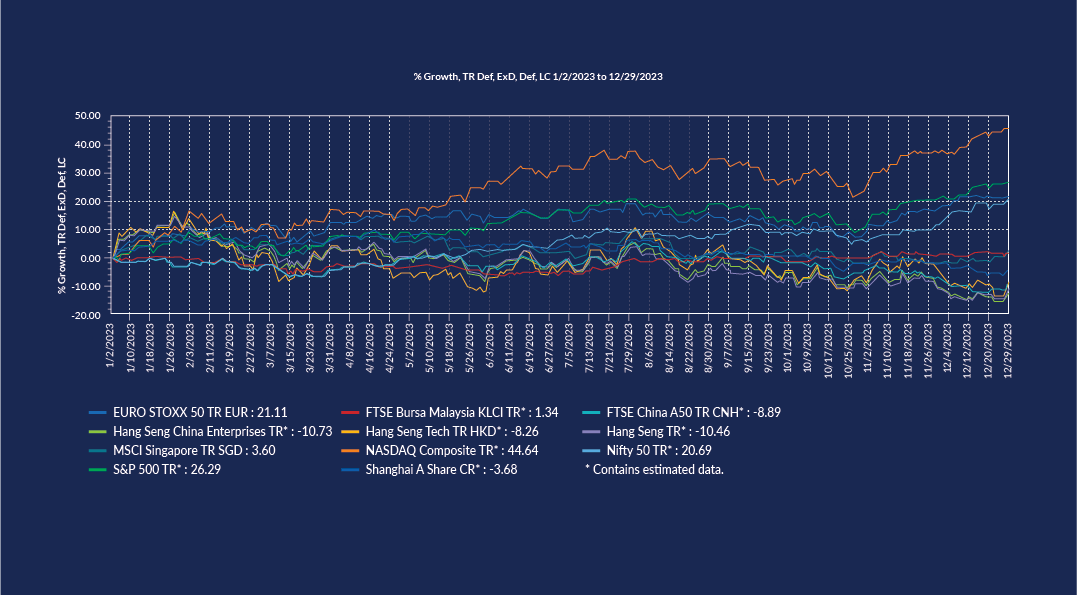

Most developed markets ended the last quarter of 2023 on a positive note. For example NASDAQ closed the year up 40%, followed by the S&P500 (26%) and EURO STOXX 50 (21%). The Chinese equity market disappointed investors, with the HSCEI down 11%, while the FTSE China A50 dropped 9%.

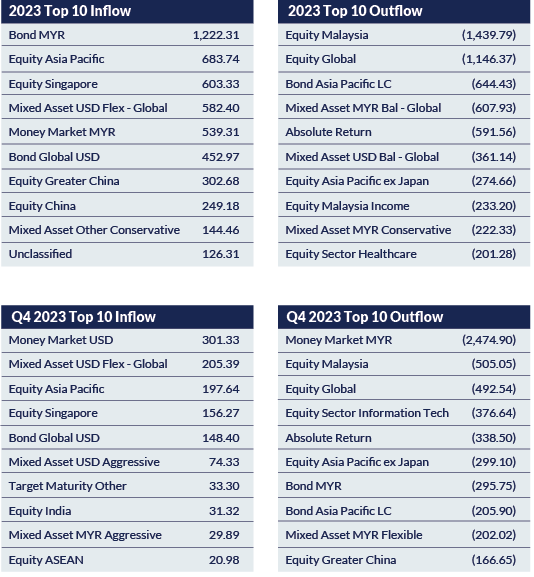

The ringgit’s persistent weakness against the US dollar throughout the year led to the influx of US dollar denominated funds. This migration was also reflected in Malaysian equities, which saw the most significant outflow among equity funds in 2023. This was not unique to Malaysian equities, however, as there was also considerable outflow across global equities, information technology, absolute return, and Asia Pacific ex-Japan strategies. The outflow effect spilled over into other equity-related funds focusing on Japan, Singapore, India, and the ASEAN region.

Within the fixed income sector, global fixed income funds gained an edge over those specific to Malaysia and the Asia Pacific region. Worries in the Chinese equity market continuing into Q4 where there has been 2 quarters of outflow from Chinese equity funds.

Source: Lipper Investment Management as of Q4 2023

Fixed income's turn to shine

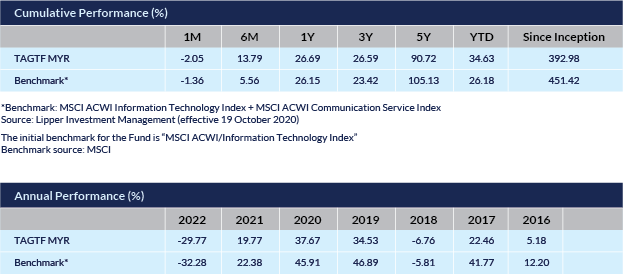

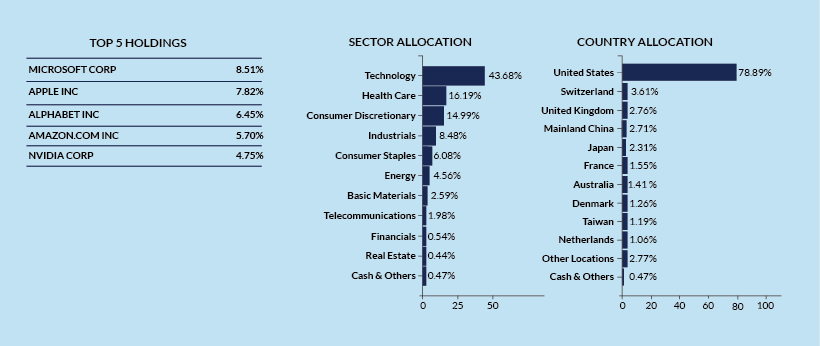

To kick off 2024, we see fixed income having a slight edge over equity. Fixed income’s yield is at a multi-year high and is also the most direct beneficiary asset from interest rate cut. Notably, the NASDAQ exhibited a substantial increase of 45% throughout 2023, and this positive momentum in the US equity market, particularly in the technology and AI sector may potentially continue into the beginning of 2024.

Source: TA Global Technology Fund Fact Sheet as of 31 October 2023

RHB Global Shariah Equity Index Fund

For investors with a more global view, you might want to consider the RHB Global Shariah Equity Index Fund. This type of fund is designed to track components of financial market indices, such as the Dow Jones Islamic Market Titans 100.

Why we like this fund

Index funds offer broad market exposure, low operating costs, and minimal portfolio turnover. This index fund focuses on the top 50 U.S. stocks, the top 25 European stocks, and the top 25 Asian stocks. The tech sector comprises a significant portion of the index's holdings while also diversifying into other sectors including health care and consumer discretionary. These global blue-chip companies are financially robust and capable of weathering challenging business environments.

Source: HSBC Global Asset Management, 31 October 2023. Exposure in HSBC Islamic Funds - HSBC Islamic Global Equity Index Fund - 97.18%

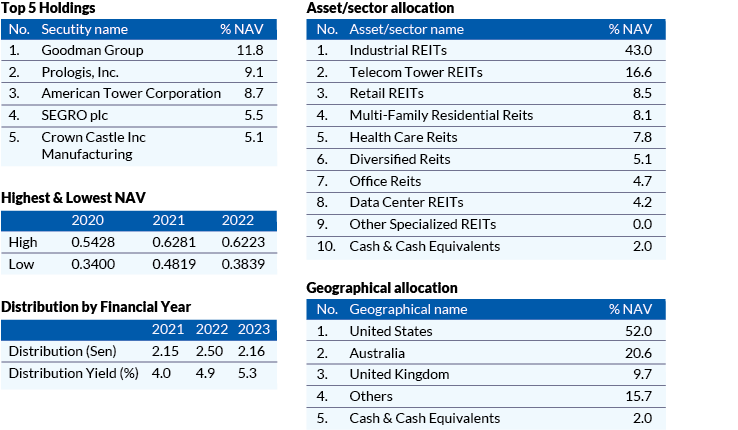

Manulife Shariah Global REIT Fund

Let’s not forget real estate. As an actively managed fund, the fund manager strategically allocates resources into REITs that are anticipated to perform strongly within their respective categories. This REIT fund has over 50% exposure in industrial and telecom tower REITs.

Why we like this fund

REITs present the potential for both capital appreciation and income generation. To qualify for favourable tax treatment, REITs are required to distribute a significant portion of their income to shareholders. In addition to this structure, REITs have historically enjoyed a resurgence in total return performance following the end of monetary policy tightening cycles.

Despite encountering some negative attention, particularly concerning shopping mall and office REITs, they are still a good bet as the market is mature enough to include a diverse range of types, so you aren’t putting all your eggs in one basket.

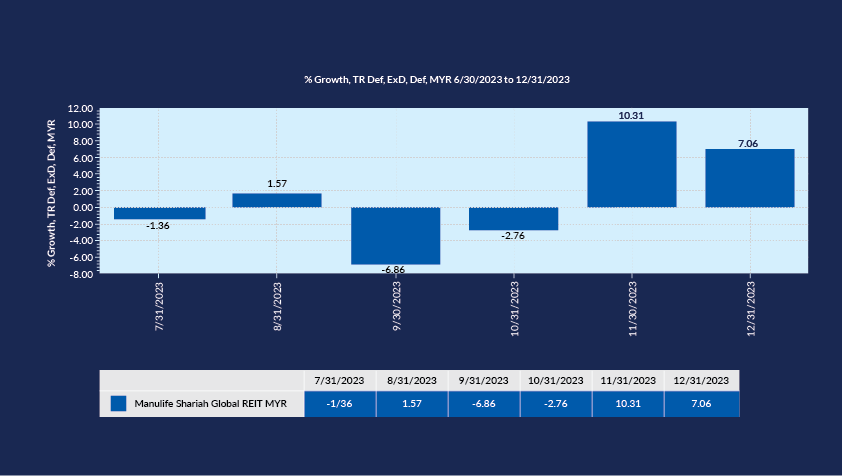

Source: Manulife Shariah Global REIT Fund Fact Sheet as of December 2023

In the final months of 2023, this fund rebounded by more than 20%. Don’t worry about missing out on lower prices, though, as the fund is still close to its starting price in 2019, just before the pandemic.

Source: Lipper Investment Management as of Q4 2023

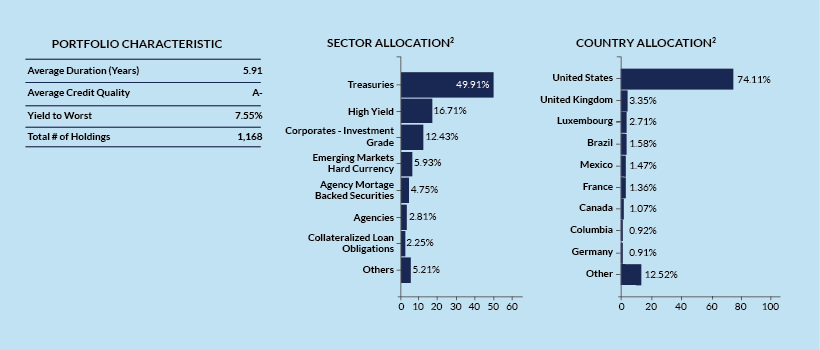

RHB American Income Fund

This fund has a diversified portfolio of more than 1,000 holdings, with most of its exposure in U.S. treasuries. At the same time, the fund manager aims to create excess returns from sources like high-yield bonds and emerging market hard currency bonds. At the feeder fund level, currency hedging is implemented to mitigate foreign currency risks. This fund offers a yield of 7.55% with a duration of 5.91 years.

Source: AllianceBernstein (Luxembourg) S.a.r.l., 31 October 2023. Exposure in AB FCP I - American Income Portfolio - 95.89%

Why we like this fund

With the prospect of rate cuts becoming a reality, this fund holds great potential as bonds are expected to benefit directly from lower rates.

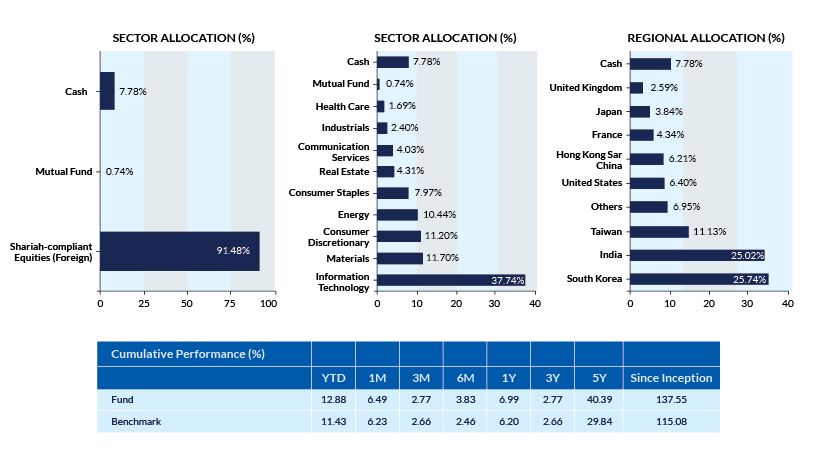

Principal Islamic Asia Pacific Dynamic Equity Fund

What about Asia? The Principal Islamic Asia Pacific Dynamic Equity Fund is a bottom-up fund offering good diversification options within the continent in India, Taiwan, and South Korea.

Why we like this fund

There are plenty of little pockets of opportunity in various Asian countries and sectors and this fund strategically positions the investors to make the most of them. This fund has consistently outperformed its benchmark in the past and may also invest up to 20% of its NAV in global companies with businesses/operations within the Asia Pacific ex-Japan region.

Disclaimer:

This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank Sdn Bhd (“RHB”).

This article has been prepared by RHB and is solely for your information only. It may not be copied, published, circulated, reproduced or distributed in whole or part to any person without the prior written consent of RHB. In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this article without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this article and are subject to change without notice. It does not constitute an offer or solicitation to deal in units of any RHB fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for him. Past performance of the fund or the manager, and any economic and market trends or forecast, are not necessarily indicative of the future or likely performance of the fund or the manager. The value of units in the fund, and the income accruing to the units, if any, from the fund, may fall as well as rise.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the TA Global Technology Fund dated 30 October 2023, RHB Global Shariah Equity Index Fund dated 16 November 2020, Manulife Shariah Global REIT Fund dated 20 October 2023, RHB American Income Fund dated 21 January 2020, and Principal Islamic Asia Pacific Dynamic Equity Fund dated 5 September 2023. (“Fund”) is available and investors have the right to request for a PHS.

The Manager wishes to highlight the specific risks of the TA Global Technology Fund are Fund Management of the Target Fund Risk, Sector Investment Risk, Currency Risk, Counterparty Risk, Temporary Suspension of the Target Fund Risk and Distribution Out of Capital Risk. The specific risks of RHB Global Shariah Equity Index Fund are Market Risk, Emerging Markets Risk, Foreign Exchange Risk, Shariah Restrictions Risk, Stock Risk, Liquidity Risk, Risks Associated with Government or Central Banks’ Intervention, Prohibited Securities Risk, Taxation Risk, Withdrawal of UK from the EU Risk, Risks relating to the Index, Counterparty Risk, Derivatives Risk, Index Tracking Risk and Operational Risk. The specific risks of the Manulife Shariah Global REIT Fund are Manager’s Risk, Market Risk, Liquidity Risk, Loan or Financing Risk, Suspension/Deferment of Redemption Risk, Fund Manager Risk, Stock Specific Risk, Country Risk, Currency Risk, Risk Considerations for Investing in Islamic Hedging Instruments, Risk Associated with Investment in REITs, Reclassification of Shariah Status Risk and Taxation Risk/Withholding Tax Risk. The specific risks of RHB American Income Fund are Country Risk – Emerging Markets, Liquidity Risk, Focused Portfolio Risk, Turnover Risk, Derivatives Risk, OTC Derivatives Counterparty Risk, Structured Instruments Risk, Fixed-Income Securities Risk – General, Fixed-Income Securities Risk – Lower-Rated and Unrated Instruments, Credit Risk – Sovereign Debt Obligations and Credit Risk – Corporate Debt Obligations. The specific risks of Principal Islamic Asia Pacific Dynamic Equity Fund are Stock Specific Risk, Risk associated with investment in Shariah-compliant warrants and/or Islamic options, Interest Rate Risk, Risk associated with investing in Islamic CIS, Country Risk, Currency Risk, Risk of investing in emerging markets, Credit and Default Risk, and other general risks are elaborated in the Information Memorandum.

This article has not been reviewed by the Securities Commission Malaysia (SC).

RHB Bank Berhad 196501000373 (6171-M) | RHB Islamic Bank Berhad 200501003283 (680329-V)