Q4 2024: Turning mixed signals into a balanced strategy

In our quarterly Fund Discovery series, we delve into current market conditions and provide insights and strategies to diversify your portfolio.

Listen and subscribe to the podcast hosted by RHB Bank’s Head of Investors Advisory, Nova Lui here to stay updated on the latest market developments.

As we head into the final quarter of 2024, we’re surrounded by mixed signals and evolving market dynamics. The strong performance of emerging markets in September, driven by Chinese equities, contrasted with the relatively flat showing in developed markets, like the US, which saw a pullback in August due to Japan’s interest rate hike affecting carry trade flows. During the Golden Week holiday when the onshore market was closed, there’s potentially room to grow on the momentum of offshore H-shares (stocks of Chinese companies traded on the Hong Kong Stock Exchange).

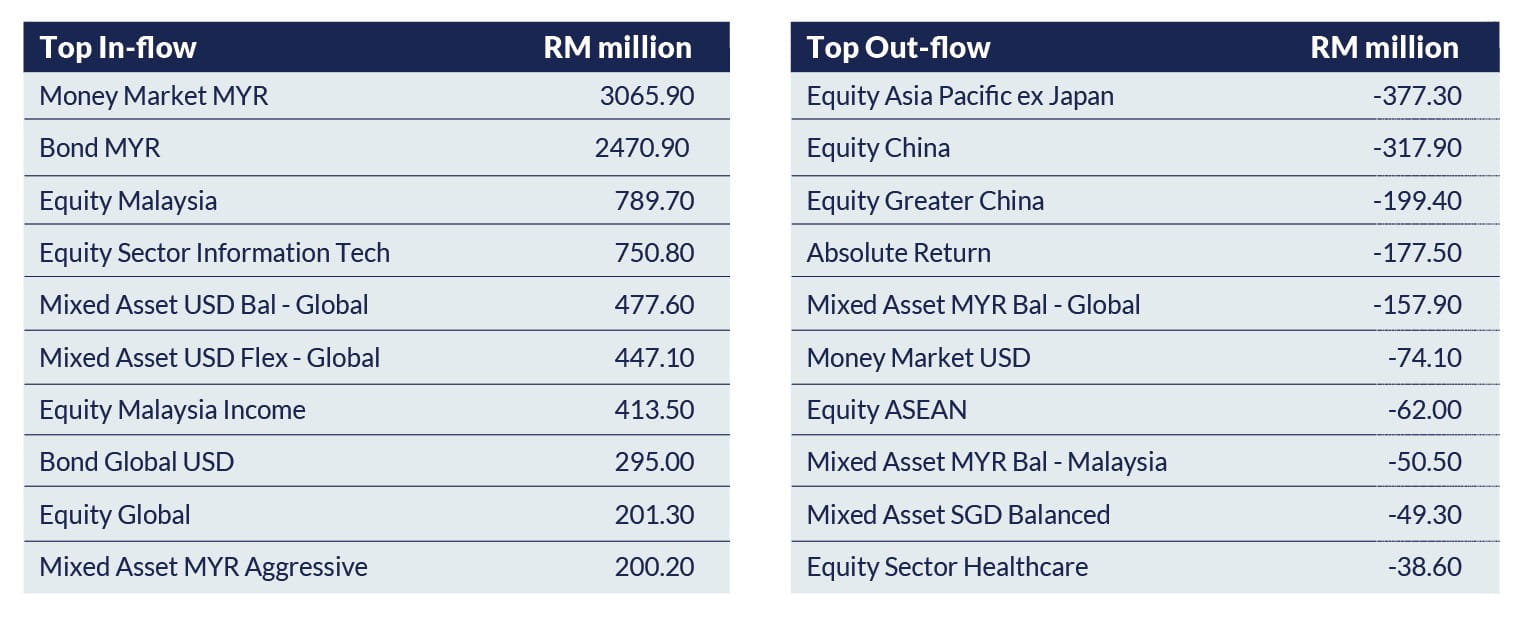

Here's a summary of inflows and outflows for Q3 2024:

Source: Lipper IM as of 30 September 2024

There was a significant inflow into Malaysian fixed income funds, outperforming global fixed income. Investors are positioning themselves to benefit from potential rate cuts that could bolster fixed income markets in the near term. The region’s mixed signals led to a net outflow of nearly RM900 million from the Chinese and Asia Pacific funds, indicating a cautious investor sentiment. The overall trend points to cautious investor sentiment, potentially driven by global market volatility, economic uncertainty in key regions, or shifting preferences toward safer or more opportunistic investment strategies.

Key themes in Q4

As Q4 unfolds, investors can focus on balancing risk through diversification across asset classes, sectors, and regions, while remaining agile enough to capitalise on market movements. Consider a strategy that blends the key ingredients of income generation, growth potential, and defensive characteristics.

Key themes shaping Q4 investment strategies include a blend of macroeconomic factors, geopolitical events, and sector-specific trends.

Monetary Policy Dynamics: Central banks' actions will significantly influence market sentiment and asset valuations. Potential rate cuts, especially in Asia, are expected to boost fixed income markets, while accommodative policies in China aim to stimulate economic activity.

The US Federal Reserve's approach to interest rates remains a critical factor, as any unexpected policy shifts could impact global equity markets and currency movements. The valuations in the US equity market remain relatively high, so investors may need to dig deeper into individual sectors, such as technology.

Growth/Recession Risks: While some regions show signs of robust economic expansion, recession concerns still loom in developed markets. For example, the US economy is being tested with high inflation and interest rates, so investors should be wary of a potential recession.

On the other hand, emerging markets, particularly in Asia, present growth opportunities, bolstered by favourable economic policies and infrastructure development. The Chinese equity market right now looks attractive with low downside risk from a lack of foreign holdings, but we’ll still need to keep an eye on the country’s fiscal policies. India is experiencing impressive economic growth, supported by strong fundamentals and investment inflows. A supportive macroeconomic environment could sustain this momentum for some time.

Malaysia is Stepping Up: It’s Malaysia’s time to shine. As a major trade partner to China, Malaysia could very well benefit from the spillover effects of the country’s accommodative policies.

With ongoing geopolitical tensions continuing to exert pressure on global supply chains, Malaysia has emerged as an attractive investment destination. The upcoming National Budget announcement could also provide a much needed feelgood factor.

However, there’s still the risk of the geopolitical pressure being too widespread, triggering volatility in the key commodities and energy sectors.

AI Advancements and Innovative Technologies: The technology sector continues to experience structural changes, driven by innovations in AI and digital transformation across industries. Companies in AI-focused regions, such as South Korea and Taiwan, are expected to benefit from strong demand for related technologies. This trend is encouraging investors to seek exposure to technology funds and AI-based equities.

Strategic recommendations for Q4

So, how can we turn these mixed signals and themes into a balanced approach? Well, that’s why you’ve read this far. We’ve come up with some strategies (and fund ideas) to help you diversify your portfolio in Q4. Your Relationship Manager can discuss these with you to determine what’s best for your risk appetite and goals.

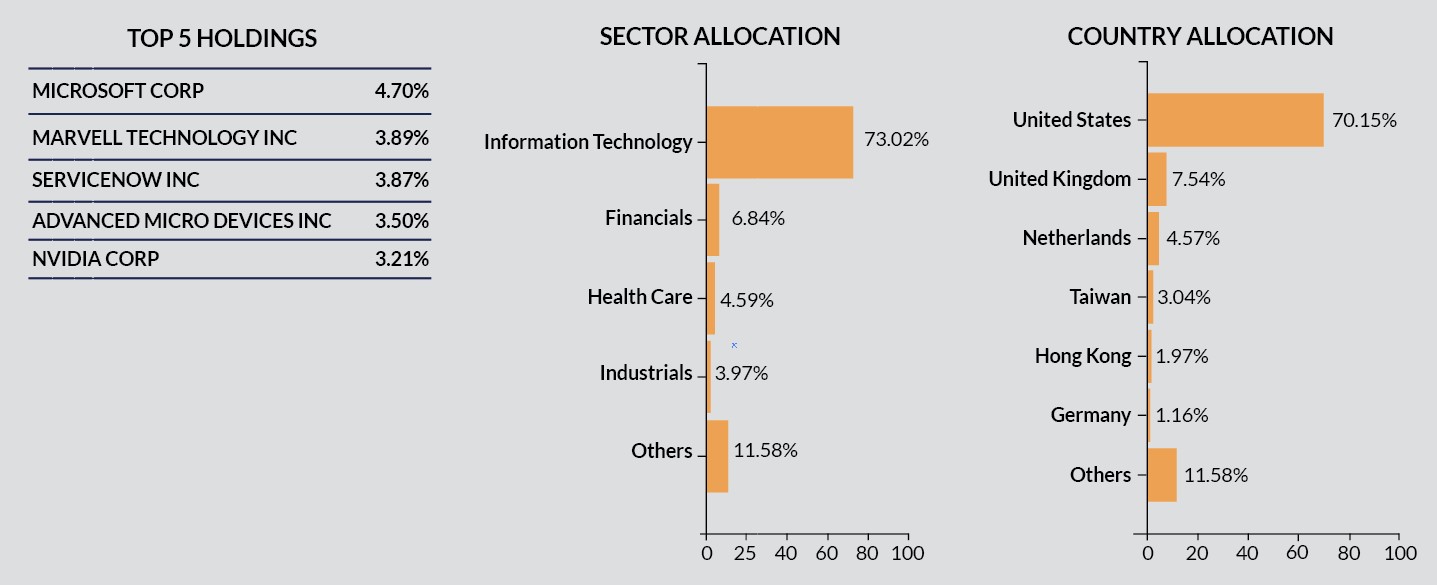

Diversify within Equities: Given the high valuations in US equities, diversification into technology-centric, dividend-focused, and income-generating strategies is a prudent move. Funds like the RHB i-Sustainable Future Technology Fund provide exposure to Artificial Intelligence (AI) while balancing risks through diversified holdings. While AI may seem like an overused term these days, the investing potential is in the all the different building blocks of generative AI. Going further down the value chain reveals plenty of new opportunities. Despite all the naysayers, generative AI will continue to have a material impact on the economy. The fund is managed by Janus Henderson, an established name in global technology funds. An experienced fund manager like Janus Henderson is great to have on your side, as picking the right stocks will deliver a better risk-to-return ratio.

Source: Medium; The Building Blocks of Generative AI; J. Shriftman; 10 July 2023

RHB i-Sustainable Future Technology Fund

Source: RHB AM Fund Fact Sheet (31 August 2024)

Mix Your Assets: Funds such as the TA Total Return Income Fund, which allocates dynamically between equities and fixed income, can help cushion against market volatility. This global mixed-asset fund is managed by Fullerton. Investors can gain exposure to specific sectors or even companies through ETFs (exchange-traded funds) or direct shares, while maintaining a foundation of fixed income assets. The core strategy allocates 60% to equities and 40% to fixed income, although this may change depending on market conditions. During favourable times, the fund allocates up to 80% to equities.

With the flexibility to adjust exposure, these funds are well-suited for investors seeking a blend of growth and income within a dynamic market. The fund’s targeted payout of 5% per annum offers some stability, too – a key factor in more volatile times.

Source: Fullerton Fund Management Company Ltd, as of July 2024

Another option is RHB Global Equity Premium Income Fund, which offers a modern twist on a “traditional” asset class. It lets you keep one foot in the fixed income door while gaining exposure to equities. The fund aims to achieve a consistent payout from the underlying dividends and options premiums. It offers exposure to the equity market and aims to consistently pay out income through underlying dividends and option premiums. This fund is a core component of our Income Investing Strategy, targeting a 7-9% annual payout, distributed monthly to investors. The underlying equity portfolio is actively managed by the J.P. Morgan Global Premium Income Investment Team.

Source: J.P. Morgan, RHBAM, March 2024 For illustration purposes only. The manager seeks to achieve the stated objectives. There can be no guarantee the objectives will be met.

1 This is not a guaranteed annual payout. The Fund Manager may in the future review the distribution policy depending on prevailing market conditions.

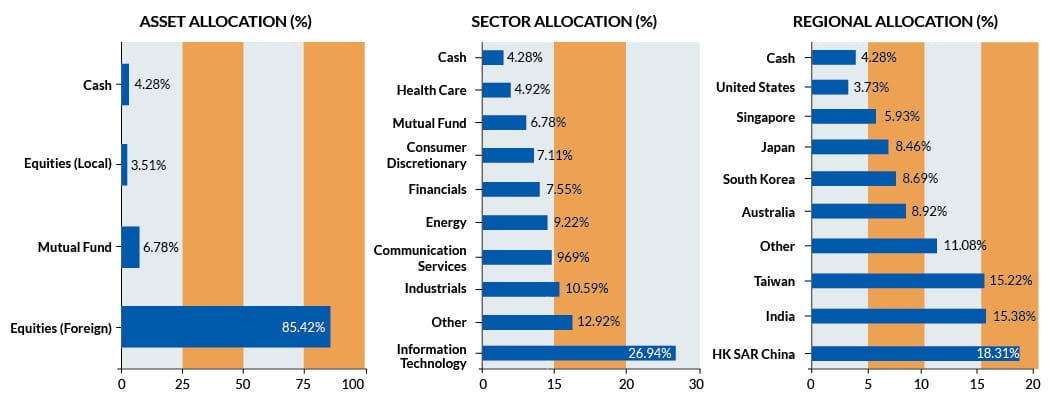

Capitalise on Regional Opportunities: The Principal Asia Pacific Dynamic Income Fund offers a strategic approach to investing in the Asia Pacific region, particularly focusing on technology-driven markets like Hong Kong, Taiwan, and India. While there is still potential for some upside in China, the fund allows for more diversification opportunities within the region. Investors are able to adjust their exposure to any country or sector within the region - wherever the fund manager identifies an opportunity. Malaysia’s potential, as mentioned earlier in the article, will not go unnoticed.

Principal Asia Pacific Dynamic Income Fund

Source: Fund Fact Sheet as of 31 August 2024

AHAM Select Dividend Fund offers exposure to the Malaysian equities market, but it also taps into dividend leaders in the rest of the Asia Pacific region, so you don’t miss out. The funds aim to provide a combination of regular income and capital growth over the medium to long term. The fund invests predominantly in high dividend-yielding equities, focusing on companies that either have strong dividend payout histories or the potential for significant dividend growth.

Source: Fund Fact Sheet as of 30 August 2024

We hope this provides some clarity going into Q4. Get in touch with your Relationship Manager today to discuss your game plan.

Disclaimer:

This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank Sdn Bhd (“RHB”).

This article has been prepared by RHB and is solely for your information only. It may not be copied, published, circulated, reproduced or distributed in whole or part to any person without the prior written consent of RHB. In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this article without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this article and are subject to change without notice. It does not constitute an offer or solicitation to deal in units of any RHB fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for him. Past performance of the fund or the manager, and any economic and market trends or forecast, are not necessarily indicative of the future or likely performance of the fund or the manager. The value of units in the fund, and the income accruing to the units, if any, from the fund, may fall as well as rise.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the RHB i-Sustainable Future Technology Fund dated 1 July 2024, TA Total Return Income Fund dated 17 May 2024, RHB Global Equity Premium Income Fund dated 22 April 2024, Principal Asia Pacific Dynamic Income Fund dated 13 July 2023, and AHAM Select Dividend Fund dated 30 December 2022. (“Fund”) is available and investors have the right to request for a PHS.

The Manager wishes to highlight the specific risks of the RHB i-Sustainable Future Technology Fund are Technology-Related Companies Risk, Sustainability Risk, Smaller Companies Risk, Currency Risk, Country Risk, Concentration Risk, and Reclassification Of Shariah Status Risk. The specific risks of TA Total Return Income Fund are External Investment Manager’s Risk, Currency Risk, Liquidity Risk, Derivatives Risk, Counterparty Risk, Commodities Risk – Gold, Collective Investment Scheme Risk, Temporary Suspension of the Collective Investment Schemes Risk, and Distribution Out of Capital Risk. The specific risks of the RHB Global Equity Premium Income Fund are Fund Management Risk, Liquidity Risk, Currency Risk, Country Risk, Interest Rate Risk, Suspension of Redemption Risk, and Distribution Out of Capital Risk. The specific risks of Principal Asia Pacific Dynamic Income Fund are Stock specific risk, Country Risk, Currency Risk, Credit and Default Risk, Interest Rate Risk, Risk associated with Investing in CIS, and Risk of Investing in Emerging Markets. The specific risks of AHAM Select Dividend Fund are Stock Specific Risk, Credit and Default Risk, Interest Rate Risk, Country Risk, Warrants Investment Risk, Currency Risk, Political Risk, Regulatory Risk, and other general risks are elaborated in the Information Memorandum.

This article has not been reviewed by the Securities Commission Malaysia (SC).

RHB Bank Berhad 196501000373 (6171-M) | RHB Islamic Bank Berhad 200501003283 (680329-V)