Save up to 40% on car insurance premium

Driving less these days doesn't only save you fuel, but also allows you to save on your car insurance premium. Simply choose a mileage plan and enjoy an instant rebate on your insurance renewal.

What is Motor Saver?

Motor Saver is uniquely designed for you to pay only for the miles you make. It is an optional premium rebate on your RHB Private Car Insurance comprehensive policy, according to the mileage plan of your choice.

However, your safety is our priority. That is why we don’t need you to compromise on your claim for loss and damage even when your mileage has exceeded. Pay only a fraction of the total repair cost based on your selected plan and we’ll cover the rest.

How does it work?

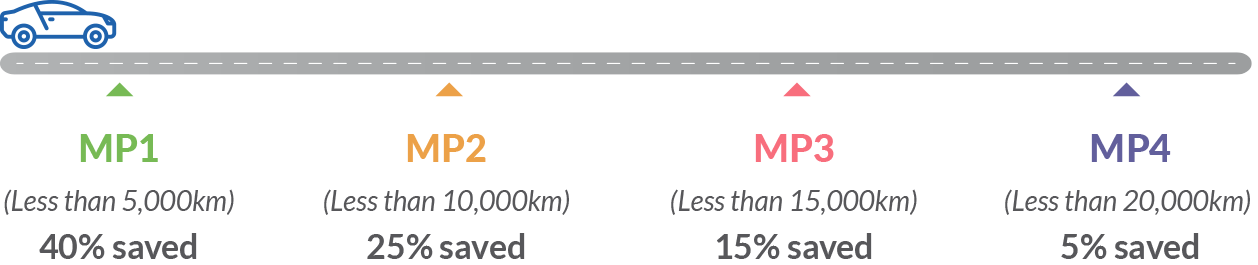

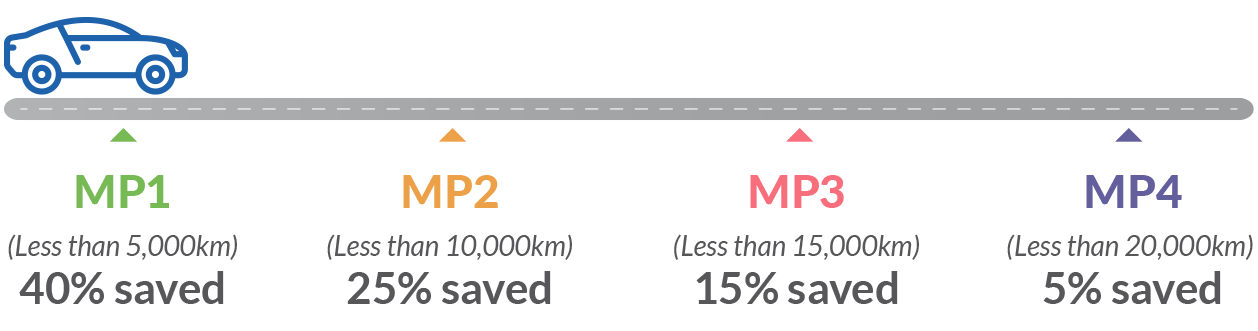

Simply select a mileage plan (MP) according to your average annual usage and get instant premium rebate from your basic car insurance premium after No-Claim Discount (NCD).

E.g. Say you have purchased MP4. If at the time of accident the miles travelled is less than 20,000km, the claim will be paid in full. If the miles travelled exceeds 20,000km, the claim will be paid partially and you will have to bear part of the cost in the same percentage as the premium rebate, in this case 5%. The miles travelled is the difference between the odometer readings at the time of purchase and at the time of accident.

What are the key benefits?

Instant premium rebate upon sign up.

No interim odometer submissions needed.

No downgrade to third party cover when you exceed your

mileage.

(subject to a proportionate reduction in claim payouts)

Enjoy 7-day bonus mileage upon sign up.

Enjoy the option to top up without underwriting fee.

Who is eligible?

All private cars with comprehensive cover.

How to get started?

Visit RHB Insurance Online

ALTERNATIVELY

Sign up via these channels

Visit any of our RHB Insurance and Bank branch

OR

Contact your preferred insurance agent

Then follow this simple guide

STEP 1

Choose your desired mileage plan

STEP 3

Submit the photo to us via intermediaries or directly upon purchase

STEP 4

Purchase completed! You've just saved on your car insurance premium

Frequently Asked Questions (FAQ)

1. Am I eligible to apply for Motor Saver?

2. Is Motor Saver compulsory for my car insurance?

3. How do I choose a mileage plan that suits my needs?

For the full FAQ, click here