Q4 2023 Fund Discovery: Opportunities in the receding tide

In our quarterly Fund Discovery Series, we discuss current market conditions and offer suggestions and strategies to diversify your portfolio.

Listen and subscribe to the podcast version by RHB Bank’s Head of Investors Advisory Nova Lui here to stay updated on the latest market developments.

Like a surfer expertly balancing on a wave, the global equities markets held steady in the third quarter of 2023. There was a mixed sentiment, with the bullish outlook fading towards the end of the quarter as a fresh selloff in the markets cut momentum. Rising bond yields and a lingering uncertainty weighed on both the equities and fixed-income segments.

The bright spark was our own KLCI, a star performer with a 5.26% increase. Coming in close behind was the Nifty 50, which represents the Indian market, with a 2.67% increase. Both were part of our fund focus in quarter 3.

The tide is receding, but there is still ongoing debate among experts on whether the US will see a recession or a soft landing. But, as the tides recede, we may spot some interesting opportunities buried in the sand.

Let’s see where the money went in Q3 before we reveal our fund picks for Q4.

Malaysian bond funds ranked top in terms of inflow, suggesting that investors were under the belief that Bank Negara Malaysia (BNM) had reached the peak of its rate hike cycle. On the foreign fixed-income side, global bond funds had a slight edge over Asia Pacific bond funds. In the equities market, global technology equities funds were a firm favourite, while investors shied away from various Malaysian equity strategies.

Source: Lipper Investment Management September 2023

This is the first time in the past year that we observed a net outflow in Chinese equity funds, however, it was still relatively small compared to the substantial inflow of RM1 billion over the course of the year, allowing it to maintain the highest inflow in the entire industry over this period. This shows that some investors have started to diversify away from Chinese equity funds.

Fixed income to benefit in Q4

Heading into Q4, the peak of the hike rate cycle is expected to continue to give an edge over equities. However, that doesn't rule out the equities market entirely. There’s still huge potential in the global technology space, particularly strategies that incorporate the AI ecosystem. The Federal Reserve is nearing the end of its tightening phase, and the US is expected to transition into policy easing, leading to an upward momentum.

Which now takes us to our fund picks for Q4.

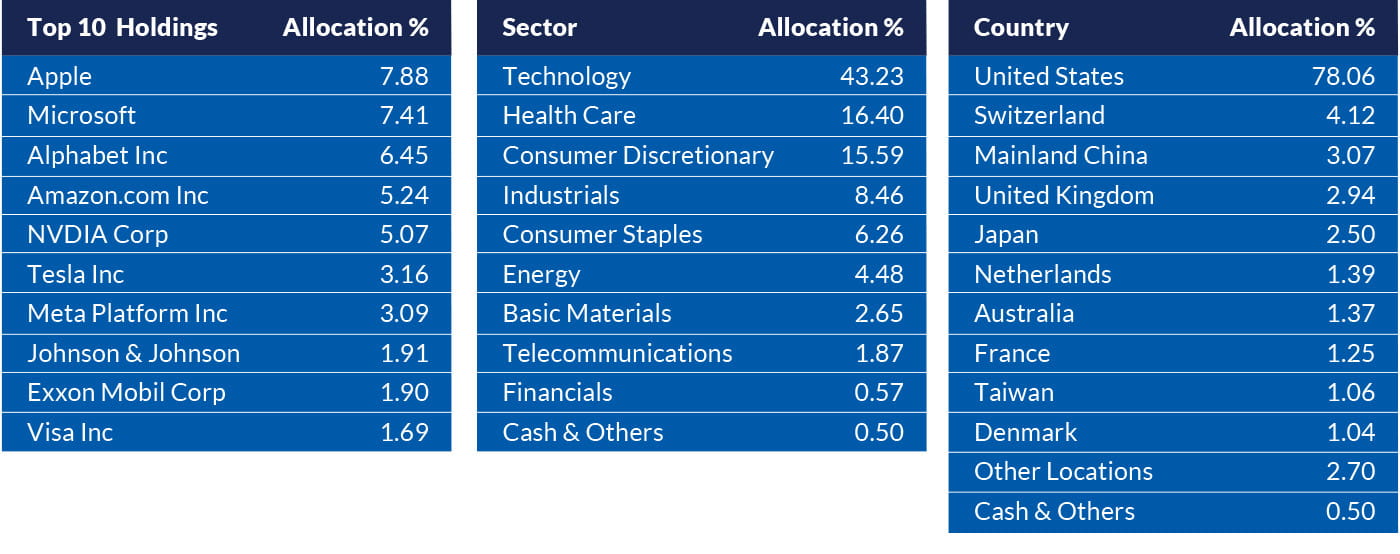

RHB Global Shariah Equity Index

This type of fund is designed to track components of equity market indices, such as the Dow Jones Islamic Market Titans 100. Index funds offer broad market exposure, low operating costs, and minimal portfolio turnover.

RHB Global Shariah Equity Index - Basic Fund Features & Key Catalyst

Source: Dow Jones Islamic Market Titans 100 Fund Factsheet, HSBC Global Asset Management

For investors who are willing to take on higher risks, there's the option to delve into sectoral funds, particularly those focused exclusively on the technology sector.

We have two suggestions for this:

TA Global Technology and RHB i-Sustainable Future Technology funds

Both leverage the extensive experience of Janus Henderson's global technology team across various market cycles and technology trends.

Why we like these funds

Bargain time! The drop in the tech-heavy NASDAQ 100 in Q3 presents an opportunity for investors to get high-quality US tech stocks at a lower price.

Growth-oriented stocks, such as tech, tend to be sensitive to the Fed Fund Rate (FFR) and US Treasury yields. If a rate cut materialises sooner, we can expect to see this positivity reflected in the technology sector. Based on the CME’s FED watch Tool, there is a higher probability of FFR being cut in 2H 2024.

Given the prolonged market uncertainties, it would be a prudent move to focus on large-cap companies with strong cash flows that can withstand potential bumps along the road, such as a mild recession.

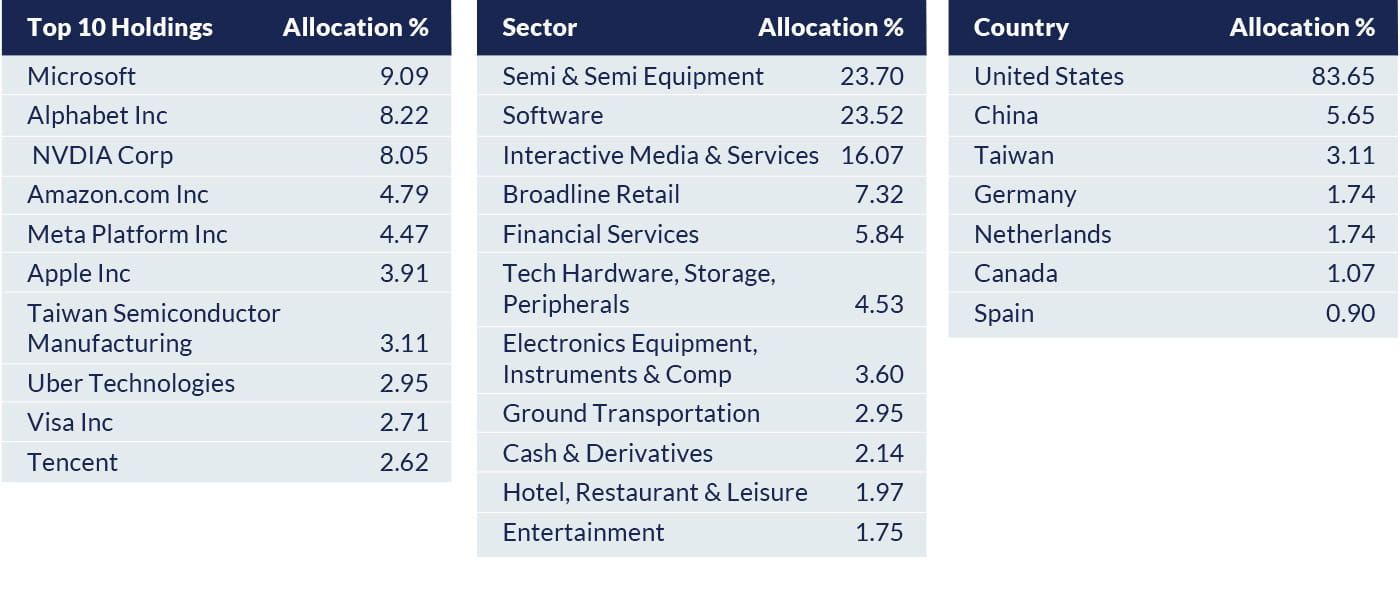

In addition to U.S. tech, both funds also have exposure to Asian technology stocks, such as Tencent and TSMC, which are key contributors to the region’s equity market. TA Global Technology has a commendable track record in Malaysia and is one of the top-performing technology funds in the market. Year to date, the fund has seen an impressive increase of 23.40% (as of 30 September 2023). Its strength lies in its focus on the five powerful secular themes for growth: Fintech, Internet 3.0, Next Generation Infrastructure, AI and Process Automation and Electrification. The fund leans more towards FAANG stocks: Meta (META) (formerly known as Facebook), Amazon (AMZN), Apple (AAPL), Netflix (NFLX); and Alphabet (GOOG) (formerly known as Google).

TA Global Technology - Asset & Country Allocation (31 August 2023)

Source: Wellsaid Labs

Although most generative AI companies are based in the West, it’s essential not to overlook investment opportunities in Asia. Let’s create an overview of the AI landscape. While this diagram is not exhaustive, it provides a useful guide for identifying direct and indirect players in the Asian markets.

Source: Janus Henderson - Global Technology Leaders Fund Factsheet (31 August 2023)

RHB i-Sustainable Future Technology Fund

RHB i-Sustainable Future Technology Fund is the first Shariah Sustainable Technology Strategy in the market. This fund offers a greater diversification across various technology stocks. There are significant and very broad investment opportunities within the sustainable technology sector that are aimed at helping solve global sustainability challenges.

*Source: Gartner Research, January 2023.

Source: Janus Henderson Investors, as at 31 January 2023.

Note : The above are the team’s view and subject to change without notice. References made to individual theme do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable.

Let’s not forget AI. RHB Global Artificial Intelligence is a niche fund that focuses only on AI companies within the tech sector.

RHB Global Artificial Intelligence Fund

Why we like this fund

Since the launch of ChatGPT, generative AI has garnered significant attention and discussions around its commercial potential. It is believed that generative AI could contribute up to USD 4.4 trillion to the global economy.

The fund’s strategy includes a wide and diverse array of AI-related solutions, which are managed differently compared to a typical tech fund. The fund taps into the multiple layers within the AI landscape, and investors have the chance to catch the wave in the early stages of the growth cycle.

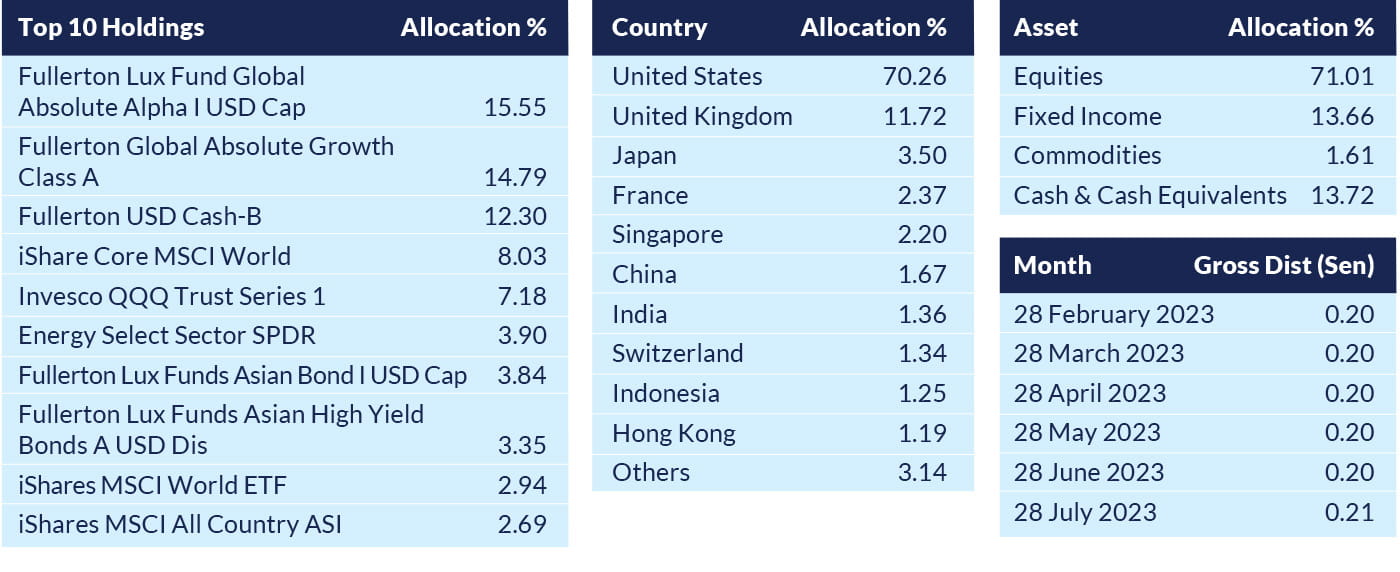

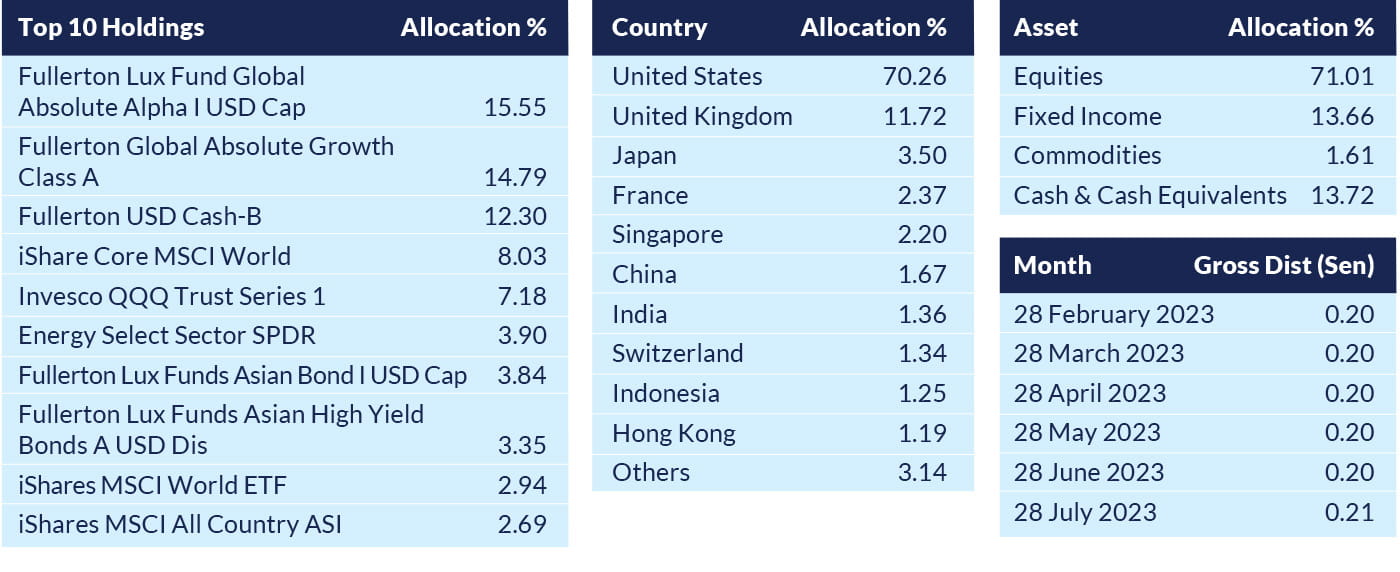

For investors seeking a more moderate approach, we present the TA Total Return Income Fund. This is a global mixed-asset fund managed by Fullerton. This is an income fund where the fund aims to pay a monthly distribution of 5% pa from its NAV.

TA Total Return Income Fund - Fund Features

Source: TA Investment - TA Total Return Income Fund Presentation Deck (August 2023)

The core strategy allocates 60% to equity and 40% to fixed income, although the fund manager may adjust allocations based on market conditions. Exposure to a specific sector or company can be achieved through means such as allocating to ETFs or directly investing in underlying shares.

TA Total Return Income Fund - Asset & Country Allocation (31 July 2023)

Source: TA Investment - TA Total Return Income Fund Presentation Deck (August 2023)

Now, how can one benefit most from potential rate cuts? Here’s where we introduce the RHB American Income Fund.

Why we like this fund

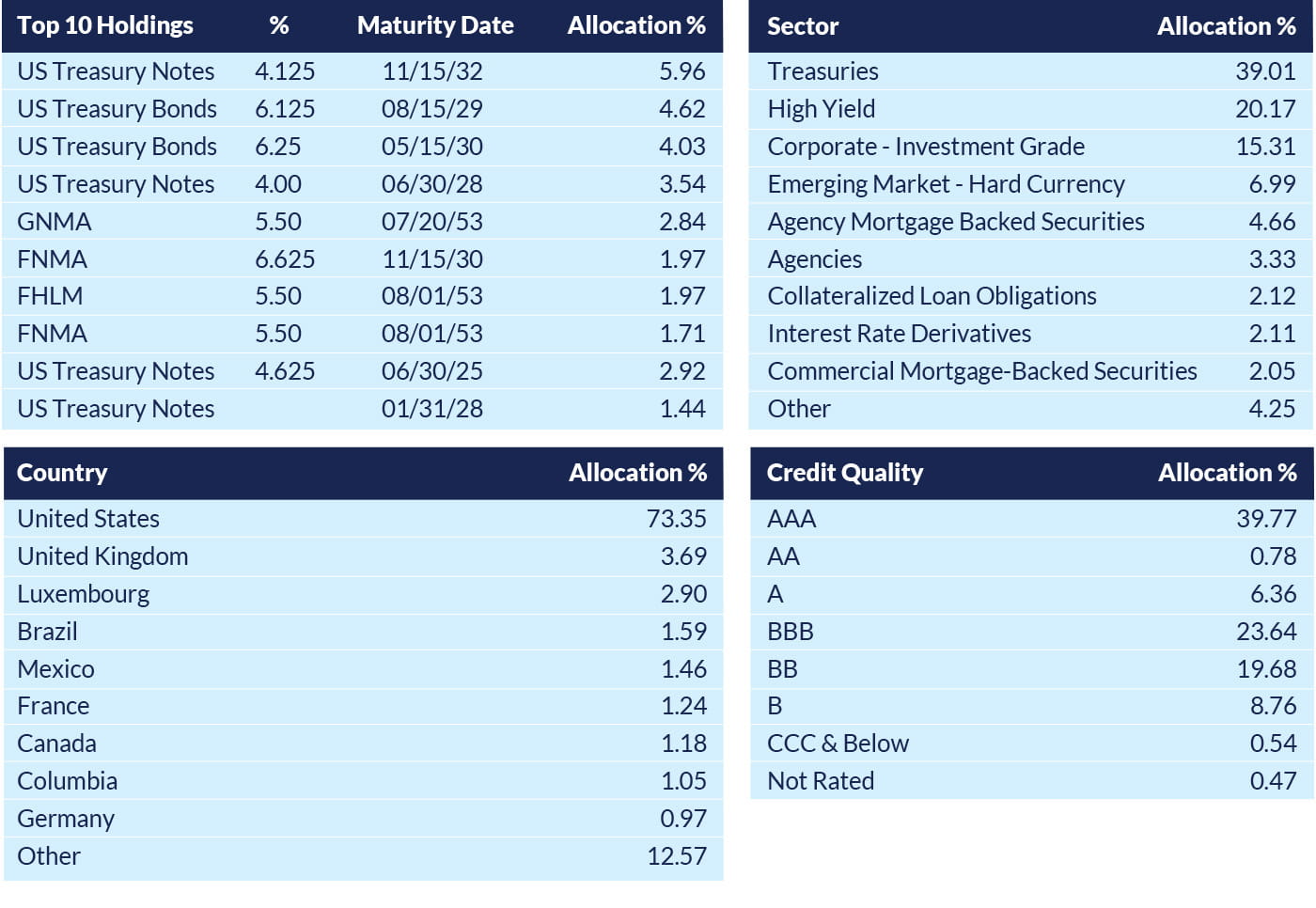

This fund offers a yield of 6.59% with a duration of 5.55 years. This diversified portfolio of more than 1,000 holdings is mainly exposed in US treasuries, while the fund manager also aims to create excess returns from sources like high-yield bonds and emerging market hard currency bonds. At the feeder fund level, currency hedging is implemented to mitigate foreign currency risks.

RHB American Income - Asset & Country Allocation (31 August 2023)

Source: AllianceBenstein American Income Portfolio (31 August 2023)

The following table shows the performance of the funds we’ve picked. There was a pullback in Q3, but over the year, the overall momentum has been positive.

Did any of the funds pique your interest? Get in touch with your Relationship Manager today to discuss your diversification options based on your risk profile and long-term goals.

Disclaimer:

This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank Sdn Bhd (“RHB”).

This article has been prepared by RHB and is solely for your information only. It may not be copied, published, circulated, reproduced or distributed in whole or part to any person without the prior written consent of RHB. In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this article without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this article and are subject to change without notice. It does not constitute an offer or solicitation to deal in units of any RHB fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for him. Past performance of the fund or the manager, and any economic and market trends or forecast, are not necessarily indicative of the future or likely performance of the fund or the manager. The value of units in the fund, and the income accruing to the units, if any, from the fund, may fall as well as rise.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the RHB Global Shariah Equity Index Fund dated 16 November 2020, TA Global Technology Fund dated 30 October 2023, RHB i-Sustainable Future Technology Fund dated 30 May 2023, RHB Global Artificial Intelligence Fund dated 15 December 2022, TA Total Return Income Fund dated 11 January 2023, and RHB American Income Fund dated 21 January 2020. (“Fund”) is available and investors have the right to request for a PHS.

The Manager wishes to highlight the specific risks of the RHB Global Shariah Equity Index Fund are Market Risk, Emerging Markets Risk, Foreign Exchange Risk, Shariah Restrictions Risk, Stock Risk, Liquidity Risk, Risks Associated with Government or Central Banks’ Intervention, Prohibited Securities Risk, Taxation Risk, Withdrawal of the UK from EU Risk, Risks relating to the Index, Counterparty Risk, Derivatives Risk, Index Tracking Risk and Operational Risk. The specific risks of TA Global Technology Fund are Fund Management of the Target Fund Risk, Sector Investment Risk, Currency Risk, Counterparty Risk, Temporary Suspension of the Target Fund Risk and Distribution Out of Capital Risk. The specific risks of RHB i-Sustainable Future Technology Fund are Fund Management Risk, Redemption Risk, Loan/Financing Risk, Risk of Non-Compliance, Returns are Not Guaranteed Risk, Risk of Termination of the Fund, Inflation Risk, Market Risk, Liquidity Risk, Islamic Financial Derivatives Risk, Shariah-Compliant Equity-Related Securities Risk, Profit Rate Risk, Default Rate & Credit Risk, Technology-Related Companies Risk, Sustainability Risk, Smaller Companies Risk, Currency Risk, Country Risk, Concentration Risk, Reclassification of Shariah Status Risk. The specific risks of RHB Global Artificial Intelligence Fund are General Market Risk, Currency Risk, Emerging Markets Risk, Liquidity Risk, Company-Specific Risk, Concentration Risk, Volatility Risk, Derivatives Risk, Sector and Theme Fund Risk. The specific risks of TA Total Return Income Fund are External Investment Manager’s Risk, Currency Risk, Liquidity Risk, Derivatives Risk, Counterparty Risk, Commodities Risk – Gold, Collective Investment Scheme Risk, Temporary Suspension of the Collective Investment Schemes Risk and Distribution Out of Capital Risk. The specific risks of RHB American Income Fund are Country Risk—Emerging Markets, Liquidity Risk, Focused Portfolio Risk, Turnover Risk, Derivatives Risk, OTC Derivatives Counterparty Risk, Structured Instruments Risk, Fixed-Income Securities Risk—General, Fixed-Income Securities Risk—Lower-Rated and Unrated Instruments, Credit Risk—Sovereign Debt Obligations, Credit Risk—Corporate Debt Obligations. Stock Specific Risk, Credit and Default Risk, Interest Rate Risk, Warrants Investment Risk, Country Risk, Currency Risk, Regulatory Risk and other general risks are elaborated in the Information Memorandum.

This article has not been reviewed by the Securities Commission Malaysia (SC).

RHB Bank Berhad 196501000373 (6171-M) | RHB Islamic Bank Berhad 200501003283 (680329-V)