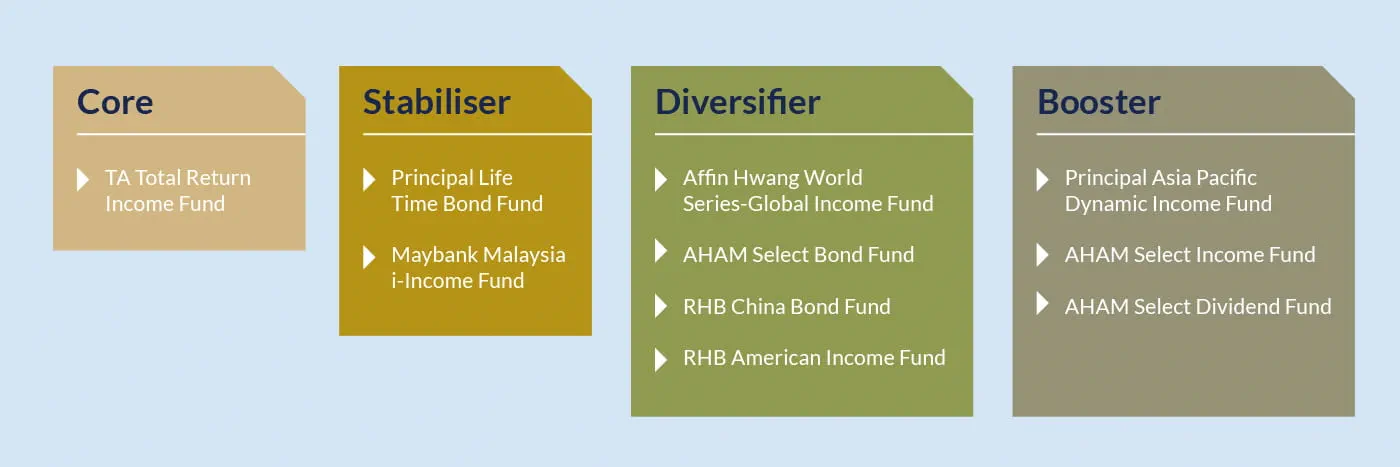

Core Pillar - Provide Consistent Monthly Income Distribution from Mixed Assets

The Core pillar is the cornerstone of RHB Bank's Income Investing Portfolio, anchored by the TA Total Return Income Fund. The fund manager aims to pay out 5% annual distribution from its NAV (Net Asset Value) on monthly basis. The fund invests into a diversified global portfolio of both equity and fixed income and actively allocate between asset classes and geographical (via Collective Investment Schemes) to capture quality opportunities with the aim to respond to uncertainties and to achieve regular income.

Stabiliser Pillar - Provide a Safety Net Against Unfavourable Currency Market Movement

The Stabiliser Pillar is designed to provide stability in volatile markets. It shields investors from currency risks. These funds are primarily invested in Malaysia’s fixed income assets denominated in MYR.

Source: Lipper Investment Manager as of October 2023

*The Lipper Rating for Consistent Return identifies a fund that has provided relatively superior consistency and risk-adjusted returns when compared to a group of similar funds. Funds which achieve high ratings for Consistent Return may be the best fit for investors who value a fund's year-to-year consistency relative to other funds in a particular peer group. Investors are cautioned that some peer groups are inherently more volatile than others, and even Lipper Leaders for Consistent Return in the most volatile groups may not be well suited to shorter-term goals or less risk-tolerant investors. (Source: Lipperleaders.com).

The top 20% of funds receive a rating of ‘5’, the next 20% of funds receive a rating of ‘4’, the middle 20% of funds receive a rating of ‘3’, the next 20% of funds receive a rating of ‘2’, the lowest 20% of funds receive a rating of ‘1’ (Source: Lipperleaders.com)

Diversifier Pillar - Provide Diversified Source of Income Distribution

The Diversifier Pillar allows investors to diversify the source of income distribution by investing into fixed income funds across various geographical regions, These funds are strategically diversified into Global, Asian, US or China fixed income markets.

Source: Lipper Investment Manager and Fund Fact Sheets as of October 2023

Booster Pillar - Potential Capital Appreciation from Exposure into Equity investment.

The Booster Pillar allow investors to allocate into funds with equity exposure. Funds in this pillar can be conservative, balance mixed assets or equity funds with 30% to 100% exposure into equity. These funds also offer periodic income distribution, if any.

Source: Lipper Investment Manager and Fund Fact Sheets as of October 2023

Based on your needs, goals and risk appetite, you can allocate your investments accordingly to these four pillars. Your Relationship Manager can help you assess your approach. Here are some tips to get the ball rolling:

Income Focus: Investors seeking a consistent income stream should focus on the Core and Stabiliser Pillars. A significant portion of the portfolio can be allocated to the TA Total Return Income Fund.

Capital Gains: Investors willing to take on more risk for potential higher capital gains may consider allocating a portion of their portfolio to the Booster Pillar.

It's important to note that each investor's financial situation and goals are unique and some of the funds are only applicable to high net worth individual. It is advisable to consult with your Relationship Manager to determine which approach aligns best with your specific goals and risk tolerance.

Get in touch with your Relationship Manager today to discuss your options!

Disclaimer:

A Product Highlights Sheet (PHS) highlighting the key features and risks of the TA Total Return Income Fund dated 11 January 2023 is available and investors have the right to request for a PHS Investors are advised to obtain, read and understand the PHS and the contents of the Information Memorandum and its supplementary(ies) (if any) (“the Information Memorandum”) before investing. The Information Memorandum has been registered with the Securities Commission Malaysia who takes no responsibility for its contents The SC’s approval and authorization of the registration of the Information Memorandum should not be taken to indicate that the SC has recommended or endorsed the Fund.

Amongst others, investors should consider the fees and charges involved. Investors should also note that the price of units and distributions payable, if any, may go down as well as up. Where a distribution is declared, investors are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from cum distribution NAV to ex distribution NAV. Any issue of units to which the Information Memorandum relates will only be made on receipt of a form of application referred to in the Information Memorandum. For more details, please call 1 800 88 3175 for a copy of the PHS and the Information Memorandum or collect one from any of our branches or authorised distributors. Investors are advised that investments are subject to investment risk and that there can be no guarantee that any investment objectives will be achieved. Investors should conduct their own assessment before investing and seek professional advice, where necessary and should not make an investment decision based on this presentation slides solely. Subscription of units of the Fund is only open to sophisticated investors.

The manager wishes to highlight the specific risks of the TA Total Return Income Fund are External Investment Manager’s Risk, Currency Risk, Liquidity Risk, Derivatives Risk, Counterparty Risk, Commodities Risk – Gold, Collective Investment Scheme Risk, Temporary Suspension of the Collective Investment Schemes Risk, Distribution Out of Capital Risk.

Investors are advised to read and understand content of the relevant documents including but not limited to prospectus or information memorandum that has been registered with Securities Commission and Product Highlight Sheet before investing. Investors should also consider all fees and charges involved before investing. Prices of units and income distribution, if any, may go down as well as up; where past performance is no guarantee of future performance. Units will be issued upon receipt of the registration form referred to and accompanying the Prospectus. The printed copy of prospectus and Product Highlight Sheet is available at RHB branches/Premier Centre and investors have the right to request for a Product Highlight Sheet.

This material has not been reviewed by the Securities Commission Malaysia (SC).