Quickly run the numbers and see what is comfortable for you.

Please note that the results from this calculator is for illustration purposes and subject to fully disbursed amount only. Results do not represent approval of the loan which is subject to RHB’s credit evaluation.

Property eligibility

Supporting Documents Required Along

With Your Property Financing Application

Property Takaful

Shariah compliance meets protection – choose what works for you!

Disclaimer:

The information contained herein is strictly meant to be general information and reference only. It does not constitute a contract of Takaful. For further details on the benefits, exclusion and terms and conditions of the product, please refer to the Product Brochure, Product Disclosure Sheet (PDS), Sales Illustration and certificate contract (where applicable). Underwritten by Syarikat Takaful Malaysia Keluarga Berhad, RHB is merely acting as a distributor.

NOTE:

Syarikat Takaful Malaysia Keluarga Berhad is a member of PIDM.

The benefit(s) payable under eligible certificate is protected by Perbadanan Insurans Deposit Malaysia (PIDM) up to limits. Please refer to PIDM’s Takaful and Insurance Benefits Protection System (TIPS) Brochure or contact Syarikat Takaful Malaysia Keluarga Berhad or PIDM (visit www.pidm.gov.my).

The developer is an extremely important element in having a stress-free experience in purchasing your dream property - take your time to research these factors in choosing a developer:

Once you’ve identified your developer, consider submitting your application for financing through the developer’s panel financier to speed up the process. Panel financiers save you time as there is no need to empanel the developer/ project.

Bonus: Some developers partner with panel financiers to provide financing for renovation/improvement packages.

If you’re buying a completed house through the secondary market, make sure you’ve completed these checks:

First and foremost - check if the current owner is actually the legal owner of the property. To do this, just ask for a copy of the title deed of the property where you will find out who the property owner is and if there are any outstanding encumbrances on the property.

Secondly, check if the individual/strata title has been issued at the time of transaction. For properties under the master title, engage your lawyer to check two things – ensure that the original developer is still active and if the developer has submitted an application for sub-division of master title for issuance of strata title. In the case where the developer has been wound up and an application has not been sent, avoid these transactions - many banks do not finance such properties.

Thirdly, find out if the property is leasehold - and if so, how long is the balance tenure. Certain banks may have a policy against leasehold property financing if the balance tenure is shorter than a certain number of years.

Make a property inspection twice - before committing on the purchase and during completion of the transaction where vacant possession is handed over. This ensures all remaining issues on the property’s condition is duly addressed between the buyer and seller.

We finance residential property and also commercial property. Click here for the list of product that we are offering.

Check how much you’re eligible for by trying our Mortgage Calculator and start your application today.

Click here for the list of documents that you need to submit during your financing application.

Third party charge is when the Sales and Purchase Agreement is under two names but financing or facility agreement is under one name, or vice versa:

The difference is that for MRTT, the coverage amount reduces year on year; whereas for MLTT, the coverage amount is fixed throughout the coverage tenure. In short, MLTT will provide fixed coverage and therefore attract higher contribution.

Both are optional but highly recommended and preference rate will be given to customers that subscribed with the bank's preferred Insurer/Takaful operator. For more info, please click here

Yes, you can either pay in cash or finance it to your financing but subject to a maximum 5%/10% of the property value.

First, the bank will conduct a final check to ensure all requirements are met before a Letter of Instruction is issued to the Documentation Solicitor.

Upon completion of legal documents preparation with relevant searches performed, the Documentation Solicitor will call you to execute the legal documents, which will take place within one month from acceptance of the offer.

If this does not happen within the time frame as mentioned, contact the Documentation Solicitor or your personal Mortgage Consultant to follow-up on the status to avoid delay on completion of legal documentation. Any delays on legal documentation may potentially lead to late disbursement, incurring late charges, save and except where such delay are attributable to the Bank or its successor-in-title's gross negligence, willful misconduct, willful default or fraud.

Once you’ve completed the legal documentations with advice of release from the documentation solicitor, the Bank will review to ensure all conditions precedent prior to disbursement have been duly complied before effecting the first disbursement.

Now it’s up to you to refer to the Letter of Offer and ensure you’ve done your part - did you remember to open a savings or current account with the Bank to facilitate standing instruction to service the monthly profit or instalment prior to the due date.

Don’t forget to read up on the terms to see if your mortgage allows you the flexibility to make prepayments or extra payments; and if so, what are the terms attached. Flexibility to make prepayments and paying profit on a daily rest basis may help save considerable profit or charges in the long term.

Check out how our Full Flexi Financing helps you save on your financing using our Mortgage Calculator.

The financial institution disburses the financing upon completion of legal documentation, or when all relevant approvals, such as the consent of the state government have been obtained. At this time, you will be informed of the amount of the first instalment you have to make and its due date.

You may cancel you financing after you accepted and signed on the Letter Offer, a cancellation fee will be charged as compensation to the Bank. Please click and read on our Product Disclosure Sheet.

1. Apa yang harus diperhatikan semasa membeli dari pemaju?

Pemaju adalah elemen yang sangat penting dalam memiliki pengalaman bebas tekanan dalam membeli hartanah impian anda - luangkan masa anda untuk meneliti faktor-faktor tersebut dalam memilih pemaju:

Setelah anda mengenal pasti pemaju anda, pertimbangkan untuk mengemukakan permohonan pembiayaan anda melalui panel pembiaya pemaju untuk mempercepatkan prosesnya. Panel pembiaya menjimatkan masa anda kerana anda tidak perlu memilih pemaju / projek.

Bonus: Sesetengah pemaju bekerjasama dengan panel pembiaya untuk menyediakan pembiayaan untuk pakej pengubahsuaian / penambahbaikan.

2. Apa yang harus diperhatikan semasa membeli hartanah sub-penjualan?

Sekiranya anda membeli rumah yang sudah siap melalui pasaran sekunder, pastikan anda telah menyelesaikan semakan ini:

Institusi kewangan mengeluarkan pembiayaan setelah selesai dokumentasi undang-undang, atau ketika semua persetujuan yang relevan, seperti persetujuan pemerintah negeri telah diperoleh. Pada masa ini, anda akan dimaklumkan mengenai jumlah ansuran pertama yang perlu anda buat dan tarikh tamat tempoh.

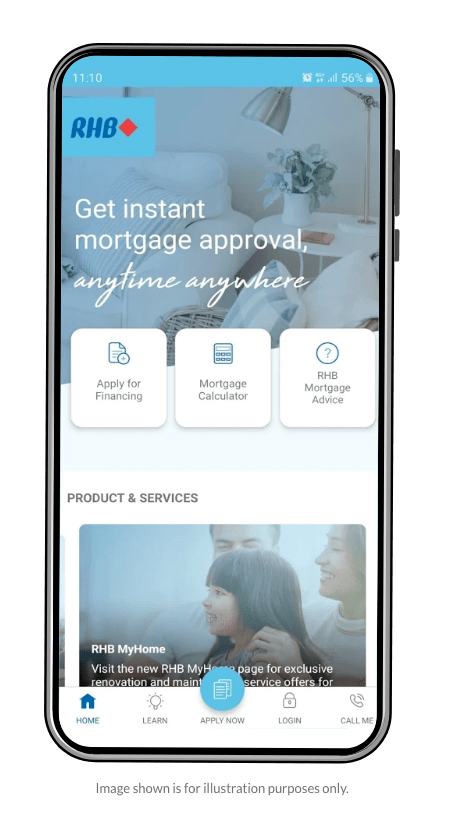

Say hello to the all-in-one space for your financing application.

Within just a few taps, you

can apply, track and stay updated.

Download the app today and get started

with your financing application!

Please share your details and we’ll get back to you. Or visit us at your nearest RHB Branch.