.jpg)

.jpg)

Get so much more than financing for your property. With RHB Islamic BizPower-i SME Property Financing, you get to grow your business with tailored products and personalised services. Rather than solely relying on your past financial statements, we place a lot of emphasis on your business experience, payment history and account activity patterns.

BizPower-i SME Property Financing provides financing to corporations that wish to acquire assets but defer the payment for the asset over a specific period. Depending on the customer's funding requirements, the financing can be offered based on the concepts of :

| IJARAH | Under the Ijarah Muntahiah Bit Tamleek (lease ending with ownership) financing arrangement, the Bank purchases the completed asset from the customer or from a third party which will subsequently lease it to the customer. The customer can purchase back the asset at the end of the lease tenure at any time during the lease tenure. It can be used under most sectors of industry such as property development, industrial, manufacturing and agricultural sectors where asset(s) is/are being acquired. |

| COMMODITY MURABAHAH BIZPOWER-i SME PROPERTY FINANCING |

Based on the concept of Tawarruq – purchase of an asset and subsequent sale of the same asset to a third party to raise funds. Commodity Murabahah Bizpower-i SME Property Financing is sale of certain specified commodities, through an exchange, on a cost plus profit basis. In this application, CM Bizpower-i SME Property Financing refers to provision of fund by RHBIB to Customer for a certain period of time supported by commodity trades as the underlying transaction. RHBIB will initiate the commodity trading with Broker A for the purchase of a specified commodity. RHBIB will then sell the commodity to the customer at cost + profit. Subsequently, customer will sell the commodity to Broker B for the same amount transacted under the initial Purchase transaction. At the end of the transaction Customer will have the finance amount available for his use in the form of Bizpower-i SME Property Financing. |

The eligibility criteria for obtaining financing are as follows:

Profile of Applicant, Shareholders and Directors

Payment Capability

Capital Commitment

Provision of Collateral

Term Financing-i provides financing to corporations that wish to acquire assets but defer the payment for the asset over a specific period. Depending on the customer's funding requirements, the financing can be offered based on the concepts of :

| IJARAH | Under the Ijarah Muntahiah Bit Tamleek (lease ending with ownership) financing arrangement, the Bank purchases the completed asset from the customer or from a third party which will subsequently lease it to the customer. The customer can purchase back the asset at the end of the lease tenure at any time during the lease tenure. It can be used under most sectors of industry such as property development, industrial, manufacturing and agricultural sectors where asset(s) is/are being acquired. |

| COMMODITY MURABAHAH TERM FINANCING-i |

Based on the concept of Tawarruq – purchase of an asset and subsequent sale of the same asset to a third party to raise funds. Commodity Murabahah Term Financing-i is sale of certain specified commodities, through an exchange, on a cost plus profit basis. In this application, CMTF-i refers to provision of fund by RHBIB to Customer for a certain period of time supported by commodity trades as the underlying transaction. RHBIB will initiate the commodity trading with Broker A for the purchase of a specified commodity. RHBIB will then sell the commodity to the customer at cost + profit. Subsequently, customer will sell the commodity to Broker B for the same amount transacted under the initial Purchase transaction. At the end of the transaction Customer will have the finance amount available for his use in the form of Term Financing-i. |

Helping SMEs with viable businesses but lacking collateral to obtain the required financing

Eligibility

Type of Facility

Profit Rate

Financing Amount

Guarantee Fee

Guarantee Cover

Based on risk profiling of SMEs:

Terms and Conditions apply

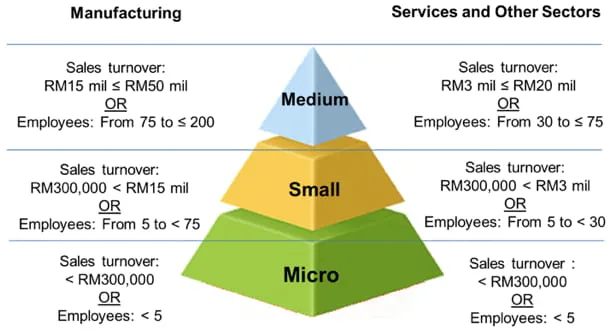

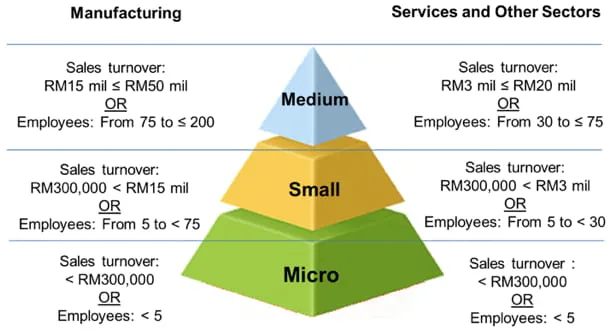

*Definition of SME by Bank Negara Malaysia (BNM) as below

Provides guarantee for financings granted under Fund for Small and Medium Industries 2 (FSMI2) and New Entrepreneur Fund 2 (NEF2)

Eligibility

Ineligibility

Purpose

Profit Rate

Financing Amount

Financing Tenure

Guarantee Cover

Guarantee Fee

Based on risk profiling of SMEs:

Terms and Conditions apply

Assisting Bumiputera SMEs with viable business but lack of collateral to obtain the required financing

Eligibility

Type of Facility

Purpose

Profit Rate

Financing Amount

Guarantee Cover

Guarantee Fee

Based on risk profiling of SMEs:

Terms and Conditions apply

*Definition of SME by Bank Negara Malaysia (BNM) as below

Under the new definition, all SMEs must be entities registered with SSM or other equivalent bodies. It however, excludes:

The fund is aimed to improve access to financing for SMEs by complementing sources of financing from FIs

Eligibility

SMEs who fulfill the following criteria:

Ineligibility

Type of Facility

Purpose

Profit Rate

Tenure

Amount of Financing

To promote growth of small and medium-sized Bumiputera enterprise in primary agriculture sectors

Eligibility

SMEs who fulfill the following criteria:

Ineligibility

Type of Facility

Purpose

A. The land cost may be included in the computation of project cost provided that:

B. Agricultural projects financed must be:

Profit Rate

Tenure

Amount of Financing

Assisting viable small businesses facing financial difficulties and/or constrained by existing non-performing financings (NPLs) by facilitating rescheduling or restructuring of financing facilities

Eligibility

Features

Terms and Conditions apply

Under the new definition, all SMEs must be entities registered with SSM or other equivalent bodies. It however, excludes:

To assist start up SME companies in all sectors to gain access to financing

Eligibility

Ineligibility

Purpose of Financing

Financing Limit

Type of Facility

Interest / Profit Rate

Guarantee Cover

Guarantee Fee

Tenure of Financing

Application Period

To assist SME companies in all sectors to gain access to financing from participating Financial Institutions (FIs)

Scheme Limit

RM17.5 billion (on revolving basis until expiry of the Scheme)

Eligibility

Open to SME companies from all sectors with at least 51% shares held and controlled by Malaysian citizens and registered with the following:

Purpose of Financing

The facility is to be used for working capital as well as for capital expense (CAPEX). The facility cannot be used to refinance existing facility granted by the same or other participating FIs

The participating FIs and/or SJPP will be responsible for determining the genuineness of the borrower / customer based on their respective credit evaluation procedures

Guarantee Coverage

70% guarantee to the financing obtained from the participating FIs (including principal and interest / profit) by the Government of Malaysia

Guarantee Fee

1% per annum payable upfront

(minimum fee of RM1,000 and renewal of guarantee coverage for a minimum period of 12 months)

Financing Limit

Tenure of Financing

Up to 17 years or until 31 December 2035, whichever is earlier

Interest / Profit Rate

Determined by participating FIs

Type of Facility

Term Loan/ Term Financing, Overdraft/ Cashline-i, Trade Facility and Commercial Card

Participating FIs

Open to all Commercial Banks, Islamic Banks and Development Financial Institutions under the purview of Bank Negara Malaysia

Source of Funds

From the participating FIs

Availability / Application Period

Opened from 1 January 2016 or upon full utilisation of the scheme limit of up to Ringgit Malaysia Seventeen Billion and Five Hundred Million (RM17.5 billion) only or upon expiry of the guarantee tenure on 31 December 2035 whichever is earlier

To assist Bumiputera SME companies in all sectors to gain access to financing from participating Financial Institutions (FIs) with lower cost of financing and improving high performance Bumiputera SME companies

Scheme Limit

RM1 billion

Eligibility

Open to Bumiputera SME companies from all sectors with at least 51% shares held and controlled by Malaysian citizens and registered with the following:

Purpose of Financing

The facility is to be used for working capital as well as for capital expense (CAPEX). The facility cannot be used to refinance existing facility granted by the same or other participating FIs

The participating FIs and/or SJPP will be responsible for determining the genuineness of the borrower / customer based on their respective credit evaluation procedures

Guarantee Coverage

70% guarantee to the financing obtained from the participating FIs (including principal and interest / profit) by the Government of Malaysia

Guarantee Fee

0.75% per annum payable upfront

(minimum fee of RM500 and renewal of guarantee coverage for a minimum period of 12 months)

Financing Limit

Tenure of Financing

Up to 17 years or until 31 December 2035, whichever is earlier

Interest / Profit Rate

Determined by participating FIs

Type of Facility

Term Loan/ Term Financing , Overdraft/ Cashline-i, Trade Facility and Commercial Card

Participating FIs

Open to all Commercial Banks, Islamic Banks and Development Financial Institutions under the purview of Bank Negara Malaysia

Source of Funds

From the participating FIs

Availability / Application Period

Opened from 1 January 2019 or upon full utilisation of the scheme limit of up to Ringgit Malaysia One Billion (RM1 billion) only or upon expiry of the guarantee tenure on 31 December 2035 whichever is earlier

To assist SME companies in all sectors to gain access to financing from participating Financial Institutions (FIs) to invest in automation and modernisation which forms part of the Industry 4.0

Scheme Limit

RM3.0 billion (on revolving basis until expiry of Scheme)

Eligibility

Open to SME companies from all sectors with at least 51% shares held and controlled by Malaysian citizens and registered with the following:

Purpose of Financing

The facility is to be used for working capital as well as for capital expense (CAPEX). The facility cannot be used to refinance existing facility granted by the same or other participating FIs.

The participating FIs and/or SJPP will be responsible for determining the genuineness of the Borrower / Customer based on their respective credit evaluation procedures

Guarantee Coverage

70% guarantee to the financing obtained from the participating FIs (including principal and interest / profit) by the Government of Malaysia

Guarantee Fee

1.0% per annum payable upfront

(minimum fee of RM1,000 and renewal of guarantee coverage for a minimum period of 12 months)

Financing Limit

Tenure of Financing

Up to 17 years or until 31 December 2035, whichever is earlier

Interest / Profit Rate

Determined by participating FIs

Type of Facility

Term Loan/ Term Financing , Overdraft/ Cashline-i, Trade Facility and Commercial Card

Participating FIs

Open to all Commercial Banks, Islamic Banks and Development Financial Institutions under the purview of Bank Negara Malaysia

Source of Funds

From the participating FIs

Availability / Application Period

Opened from 1 January 2018 or upon full utilisation of the scheme limit of up to Ringgit Malaysia Three Billion (RM3.0 billion) only or upon expiry of the guarantee tenure on 31 December 2035 whichever is earlier

The Shariah concepts applicable to CMTF-i Full Flexi (Redraw) are:

| Commodity Murabahah | Commodity Murabahah is a Tawarruq arrangement between the Bank, Customer, and Commodity Suppliers through Brokers. It refers to the trading of commodities which act as the underlying assets of a sale and purchase transaction. You will make payment to the bank for the Selling Price of the commodity, which includes cost price (“Purchase Price”) and Total Profit on deferred basis. With the concept of Tawarruq, You will receive cash proceeds in exchange for the commodities being sold off to third party. The cash proceeds shall be used to finance your intended property. |

| Tawarruq | A Tawarruq consists of two sale and purchase contracts. The first involves the sale of an asset by a seller to a purchaser on a deferred basis. Subsequently, the purchaser of the first sale will sell the same asset to a third party at cost price and on spot basis. |

| Musawamah | The Redraw amount will be traded based on Musawamah. Musawamah is a sale in which the seller is not obligated to disclose the price paid to create or obtain the good or service. When a Customer makes extra payment on their financing, the amount of the extra payment will be traded at cost price. |

| Rahn | Rahn is a contract between a pledgor (rahin) and a pledgee (murtahin) whereby an asset is pledged as collateral (marhun) to the pledgee to provide assurance that the liability or obligation against the pledgee will be fulfilled. |

| Wakalah | Wakalah refers to a contract in which a party, as principal (muwakkil) authorizes another party as his agent (wakil) to perform a particular task in matters that may be delegated, with or without imposition of a fee. |

Get so much more than just a financing solution. RHB Islamic BizPower-i SME Business Financing helps you grow your business with tailored products and personalised services by utilising the method of Commodity Murabahah via Tawarruq arrangement.

The eligibility criteria for obtaining financing are as follows:

Profile of Applicant, Shareholders and Directors

Payment Capability

Capital Commitment

Provision of Collateral

The Shariah concepts applicable to UBF-PINTAS-i are:

| Commodity Murabahah | Commodity Murabahah is a Tawarruq arrangement between the Bank, Customer, and Commodity Suppliers through Brokers. It refers to the trading of commodities which act as the underlying assets of a sale and purchase transaction. You will make payment to the bank for the sale price of the commodity, which includes cost price (“Purchase Price”) and Total Profit on deferred basis. With the concept of Tawarruq, You will receive cash proceeds in exchange for the commodities being sold off to third party. The cash proceeds shall be used to finance your working capital. |

| Tawarruq | A Tawarruq consists of two sale and purchase contracts. The first involves the sale of an asset by a seller to a purchaser on a deferred basis. Subsequently, the purchaser of the first sale will sell the same asset to a third party at cost price and on spot basis. |

| Wakalah | Wakalah refers to a contract in which a party, as principal (muwakkil) authorizes another party as his agent (wakil) to perform a particular task on matters that may be delegated, with or without imposition of a fee. |

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

PIDM Membership Representation

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

We used cookies to improve your experience on our website. By continuing to use our website and/or accepting this message, you agree to our use of cookies. Please refer to our Privacy Policy for more information.