All About Wealth Distribution

Leaving this world with unsettled financial issues can only be a

burden to our beneficiaries and loved ones. Depending on our

circumstances, Islamic estate planning can be complicated especially

when disputes arise. Whilst we still have the capacity, we need to

responsibly plan ahead in our lifetime for the benefit of our loved ones.

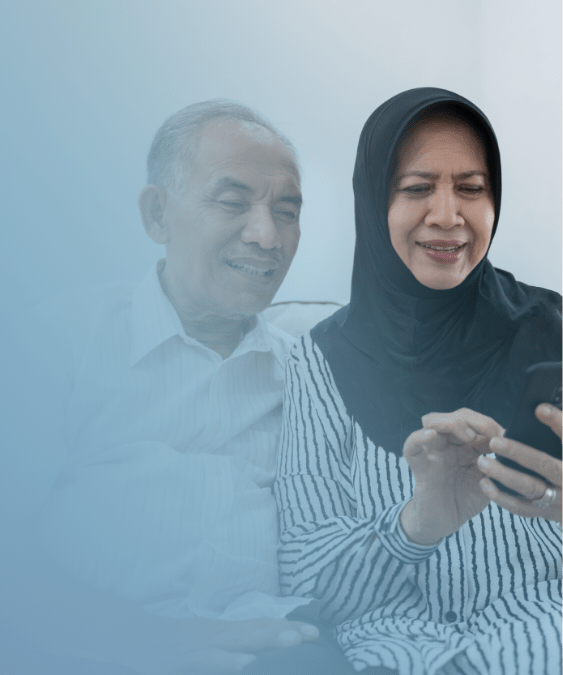

At RHB Islamic, our expert partners can assist and advise you

comprehensively in drawing up an estate plan, ensuring your needs

are met and your legacy is successfully distributed in the most

effective way.

|

|

|

Declaration of Hibah by the owner of a specific asset stating that he gives the asset to the beneficiary and he is holding the asset for the benefit of the beneficiary. It is a written document wherein the terms and conditions on which the Settlor is holding the assets are set out.

Characteristics of Declaration of Hibah:

Trustee(s)

|

|

Jointly Acquired Asset Agreement (or matrimonial property) is a property jointly acquired by both husband and wife during the subsistence of a valid marriage. Each spouse has his/her respective right over the property but the right must be claimed in court. Thus, in the event of any one of their deaths, the surviving spouse is entitled to claim her portion thereof from the deceased spouse’s estate before distribution in accordance with Faraid rules.

Trustee(s)

|

|

Trustee(s)

|

|

It is difficult to choose an executor for your Wasiat. The well-being of your family is at stake. The right person will see to it that your dependents are secure and content. The wrong person may simply leave them entangled in distress and neglect

Hence, to ensure the continuity of the administration of the estate, it is clearly more advantageous to appoint a corporate body to be an executor instead of relying on an individual.

Trustee(s)

|

|

A trust created from Takaful proceeds where the owner appoints trustee as an assignee through an Absolute Assignment and to act as trustee (“Trustee”) to receive Takaful proceeds (“Trust Fund”). The Settlor shall set up a Trust Deed to determine the terms and conditions for the administration of the Trust Fund.

Trustee(s)

|

Duties include the following :

Trustee(s)

|

Declaration of Hibah by the owner of a specific asset stating that he gives the asset to the beneficiary and he is holding the asset for the benefit of the beneficiary. It is a written document wherein the terms and conditions on which the Settlor is holding the assets are set out.

Characteristics of Declaration of Hibah:

Trustee(s)

|

|

Jointly Acquired Asset Agreement (or matrimonial property) is a property jointly acquired by both husband and wife during the subsistence of a valid marriage. Each spouse has his/her respective right over the property but the right must be claimed in court. Thus, in the event of any one of their deaths, the surviving spouse is entitled to claim her portion thereof from the deceased spouse’s estate before distribution in accordance with Faraid rules.

Trustee(s)

|

|

Trustee(s)

|

|

It is difficult to choose an executor for your Wasiat. The well-being of your family is at stake. The right person will see to it that your dependents are secure and content. The wrong person may simply leave them entangled in distress and neglect

Hence, to ensure the continuity of the administration of the estate, it is clearly more advantageous to appoint a corporate body to be an executor instead of relying on an individual.

Trustee(s)

|

|

A trust created from Takaful proceeds where the owner appoints trustee as an assignee through an Absolute Assignment and to act as trustee (“Trustee”) to receive Takaful proceeds (“Trust Fund”). The Settlor shall set up a Trust Deed to determine the terms and conditions for the administration of the Trust Fund.

Trustee(s)

|

Duties include the following :

Trustee(s)

|

Talk to us

Please share your details and we’ll get back to you. Or download our QMS app to make

an appointment at your preferred branch. Learn More.

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

PIDM Membership Representation

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

We used cookies to improve your experience on our website. By continuing to use our website and/or accepting this message, you agree to our use of cookies. Please refer to our Privacy Policy for more information.