| Range (RM) | Rates (p.a.) |

| Up to 50,000 | 0.25% |

| Above 50,000 | 0.25% |

| Range (RM) | Rates (p.a.) |

| Up to 50,000 | 2.40% |

| Above 50,000 | 0.55% |

| Range (RM) | Rates (p.a.) |

| Up to 1,000 | 0.00% |

| Up to 10,000 | 0.05% |

| Up to 20,000 | 0.15% |

| Up to 50,000 | 0.25% |

| Up to 100,000 | 0.50% |

| Above 100,000 | 1.00% |

| Range (RM) | Rates (p.a.) |

| Up to 3,000 | 0.00% |

| Above 3,000 | 0.00% |

Applicable for existing accountholders.

| Range (RM) | Rates (p.a.) |

| Up to 20,000 | 0.00% |

| Up to 50,000 | 0.05% |

| Up to 100,000 | 0.10% |

| Above 100,000 | 0.30% |

Applicable for existing accountholders.

| Range (RM) | Rates (p.a.) |

| Up to 20,000 | 0.00% |

| Up to 50,000 | 0.05% |

| Up to 100,000 | 0.10% |

| Above 100,000 | 0.30% |

Applicable for existing accountholders.

| Base Rate (p.a.) | Bonus Rate (p.a.) |

| 0.00% | 0.00% |

| Base Rate (p.a.) | Bonus Rate (p.a.) |

| 0.10% | 0.60% |

Applicable for existing accountholders.

| Category | Rates (p.a.) |

| Base Rate | 0.20% |

| Bonus Rate | 0.10% |

Applicable for existing accountholders.

| Range* (RM) | Rates (p.a.) |

| Up to 20,000 | 0.00% |

| Above 20,000 | 0.80% |

*First RM20,000 in MaxCash Account is non-interest bearing irrespective of account balance.

Applicable for existing accountholders.

| Range* (RM) | Option 1 | Option 2 |

| Rates (p.a.) | Rates (p.a.) | |

| Up to 50,000 | 0.00% | 0.00% |

| Up to 100,000 | 0.10% | 0.00% |

| Up to 500,000 | 0.35% | 0.55% |

| Up to 1,000,000 | 0.50% | 0.70% |

| More than 1,000,000 | 0.50% | 1.00% |

*No interest is paid on the first RM5,000 of your total balances

| Category | Rates (p.a.) |

| Base Rate | 0.05% |

| Tenure | Rates (p.a.) |

| 1 Month | 2.10% |

| 2 Months | 2.15% |

| 3 - 5 Months | 2.45% |

| 6 Months | 2.50% |

| 7 - 11 Months | 2.50% |

| 12 Months | 2.50% |

| >12 Months | Negotiable |

| Tenure | Rates (p.a.) |

| 12 Months | 2.50% |

| >12 months | Negotiable |

| Tenure | Rates (p.a.) |

| 3 Months | 2.45% |

| Range* (RM) | Tier 1 Rates (p.a.) | Tier 2 Rates (p.a.) |

| First 50,000 | 0.00% | 0.00% |

| Above 50,000 to 200,000 | 0.50% | 0.25% |

| Above 200,000 to 500,000 | 1.60% | 0.60% |

| Above 500,000 to 1,000,000 | 1.75% | 0.80% |

| Subsequent balances above 1,000,000 | 2.00% | 1.00% |

Note : With effect from 1 February 2024, ‘Split Tier’ concept on interest rate computation will be implemented. ‘Split Tier’ is an interest calculation method that separates the account balance according to the balance range tier.

| Standardised Base Rate | |

| Effective Date | Rates (per annum) |

| 8 May 2023 | 3.00% |

| Standard Housing Loan* | Rates (per annum) |

| Indicative Effective Lending Rate | 4.75% |

| *A standard housing loan refers to a housing loan with loan amount of RM350,000 for 30 years and has no lock-in period. | |

| Base Rate | |

| Effective Date | Rates (per annum) |

| 8 May 2023 | 3.75% |

| Base Lending Rate | |

| Effective Date | Rates (per annum) |

| 8 May 2023 | 6.70% |

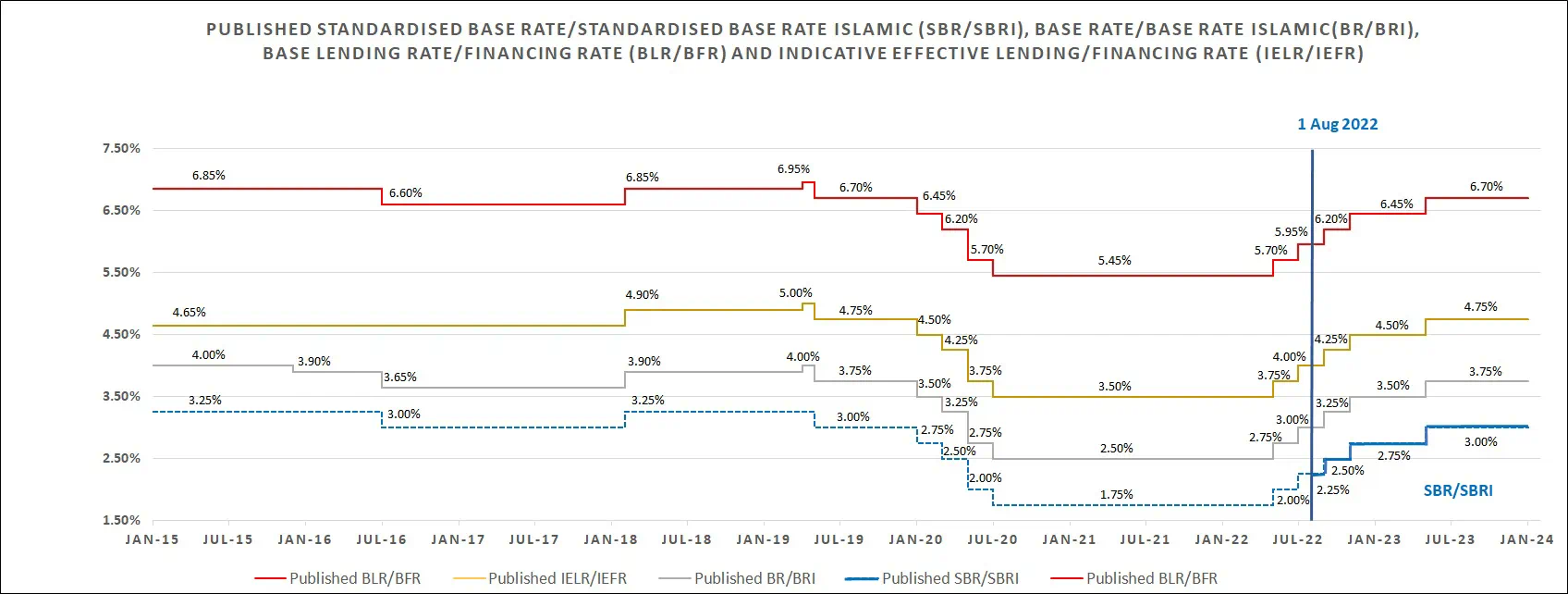

| Tarikh Berkuatkuasa / Effective Date | Jan-15 | Dec-15 | Jul-16 | Feb-18 | Apr-19 | May-19 | Jan-20 | Mar-20 | May-20 | Jul-20 | May-22 | Jul-22 | Aug-22 | Sept-22 | Nov-22 | May-23 |

| KAS / SBR | 3.25% | 3.25% | 3.00% | 3.25% | 3.25% | 3.00% | 2.75% | 2.50% | 2.00% | 1.75% | 2.00% | 2.25% | 2.25% | 2.50% | 2.75% | 3.00% |

| KA / BR | 4.00% | 3.90% | 3.65% | 3.90% | 4.00% | 3.75% | 3.50% | 3.25% | 2.75% | 2.50% | 2.75% | 3.00% | 3.00% | 3.25% | 3.50% | 3.75% |

| KPA / BLR | 6.85% | 6.85% | 6.60% | 6.95% | 6.95% | 6.70% | 6.45% | 6.20% | 5.70% | 5.45% | 5.70% | 5.95% | 5.95% | 6.20% | 6.45% | 6.70% |

| PKEP / IELR | 4.65% | 4.65% | 5.00% | 5.00% | 4.75% | 4.50% | 4.50% | 4.25% | 3.75% | 3.50% | 3.75% | 4.00% | 4.00% | 4.25% | 4.50% | 4.75% |

Rujukan / Reference:

Kadar Asas Standard (KAS) / Standardised Base Rate (SBR), Kadar Asas (KA) / Base Rate (BR), Kadar Pinjaman Asas (KPA) / Base Lending Rate (BLR), Petunjuk Kadar Efektif Pinjaman (PKEP) / Indicative Effective Lending Rate (IELR)

Catatan:

Note:

Catatan: KAS telah diperkenalkan pada 1 Ogos 2022. Garis putus-putus menunjukkan data OPR yang terdahulu, iaitu kadar penanda aras KAS.

Note: The SBR was introduced on 1 August 2022. The dotted line shows the historical series of the OPR, which is the benchmark rate of the SBR.

| Housing Loan Current Board Rate | ||

| Loan Amount | Board Rate (p.a.) | Effective Rate (p.a.) |

| < RM100,000 | SBR + 3.60% | 6.60% |

| RM100,000 - < RM250,000 | SBR + 3.60% | 6.60% |

| RM250,000 - < RM400,000 | SBR + 3.30% | 6.30% |

| RM400,000 - < RM600,000 | SBR + 3.20% |

6.20% |

| RM600,000 - < RM1,000,000 | SBR + 3.10% | 6.10% |

| RM1,000,000 & above | SBR + 3.05% | 6.05% |

| Commercial Property Financing Current Board Rate | ||

| Financing Amount | Board Rate (p.a.) | Effective Rate (p.a.) |

| <= RM500,000 | SBR + 2.80% | 5.80% |

| Above RM500,000 | SBR + 2.50% | 5.50% |

Important Note: Standardised Base Rate (SBR) is 3.00% p.a. effective 8 May 2023

A guide to our charges & rates offered

Term Deposit

| Commodity Murabahah Deposit-i (with effective 27 January 2025) |

|

| Tenure (months) | Effective Rate (% p.a.) |

| 1 | 2.10% |

| 2 | 2.15% |

| 3 - 5 | 2.45% |

| 6 | 2.50% |

| 7 - 11 | 2.50% |

| 12 | 2.50% |

| >12 months | Negotiable |

For other information, please refer to the counters.

Rates for Commodity Murabahah (CM) Deposit products

| RHB CHILDREN ACCOUNT-i (RM) (With effect from 9 May 2024) |

|

| Balance Range Tier | Profit Rate (% p.a.) |

| Up to RM 50,000 | 2.40% |

| Above RM 50,000 | 0.55% |

| Basic Savings Account-i Option 1 and Option 2 (With effect from 24 June 2020) |

Profit Rate (% p.a.) |

| Up to RM50,000 | 0.25% |

| Above RM50,000 | 0.25% |

| Saving Account-i (With effect from 24 June 2020) |

Profit Rate (% p.a.) |

| Up to RM1,000 | 0.00% |

| Up to RM10,000 | 0.05% |

| Up to RM20,000 | 0.15% |

| Up to RM50,000 | 0.25% |

| Up to RM100,000 | 0.50% |

| Above RM100,000 | 1.00% |

| Current Account-i (RM) (With effect from 13 July 2020) |

Option 1 | Option 2 |

| Rates (p.a.) | Rates (p.a.) | |

| Up to 50,000 | 0.00% | 0.00% |

| Up to 100,000 | 0.10% | 0.00% |

| Up to 500,000 | 0.35% | 0.55% |

| Up to 1,000,000 | 0.50% | 0.70% |

| More than 1,000,000 | 0.50% | 1.00% |

| RHB Premier Current Account-i (RM) (With effect from 1 April 2025) |

Tier 1 Rates (p.a) | Tier 2 Rates (p.a) |

| First 50,000 | 0.00% | 0.00% |

| Above 50,000 to 200,000 | 0.50% | 0.25% |

| Above 200,000 to 500,000 | 1.60% | 0.60% |

| Above 500,000 to 1,000,000 | 1.75% | 0.80% |

| Subsequent balances above 1,000,000 | 2.00% | 1.00% |

Note : With effect from 1 February 2024, ‘Split Tier’ concept on profit rate computation will be implemented. ‘Split Tier’ is a profit calculation method that separates the account balance according to the balance range tier.

| RHB Smart Account-i (With effect from 13 July 2020) | Rate (p.a.) |

| Base Rate | 0.05% |

Reliable, up-to-date and competitive.

Standardised Base Rate Islamic

| Effective Date | Rates (per annum) |

| 8 May 2023 | 3.00% |

| Standard Home Financing* | |

| Indicative Rate | 4.75% |

Base Rate Islamic

| Effective Date | Rates (per annum) |

| 8 May 2023 | 3.75% |

Base Financing Rate

| Effective Date | Rates (per annum) |

| 8 May 2023 | 6.70% |

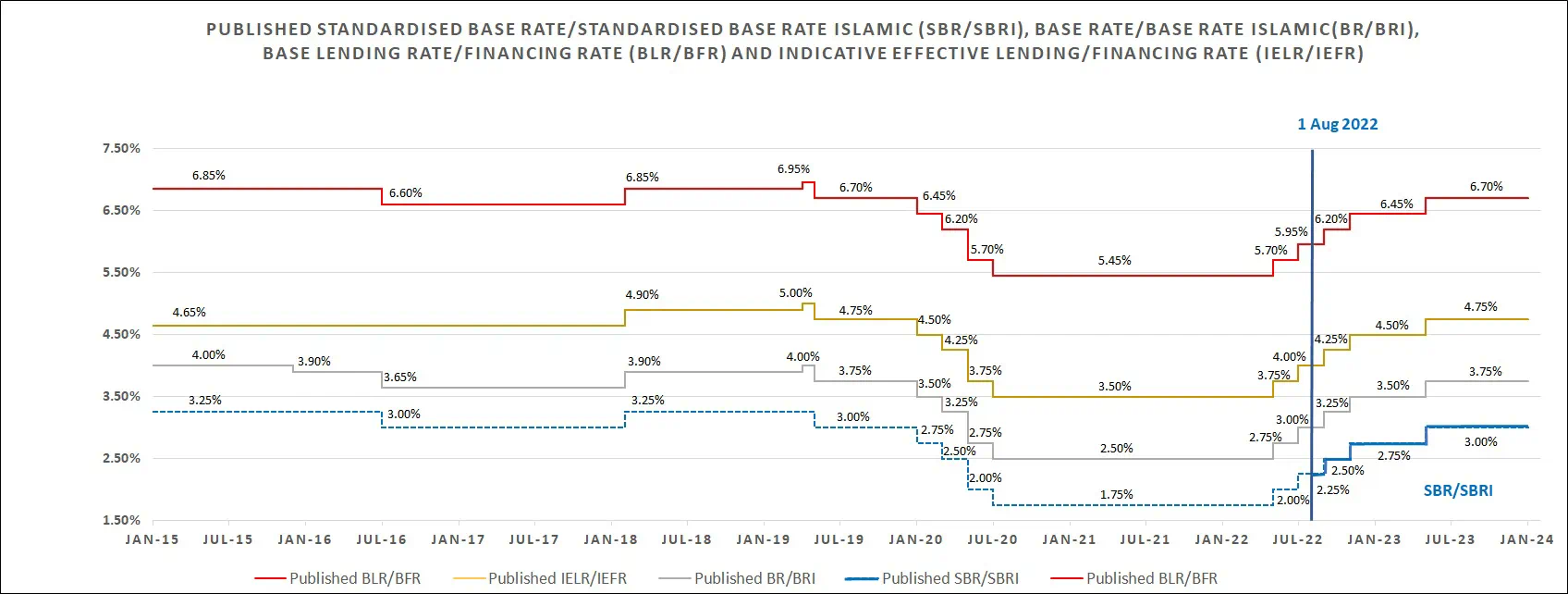

| Tarikh Berkuatkuasa / Effective Date | Jan-15 | Dec-15 | Jul-16 | Feb-18 | Apr-19 | May-19 | Jan-20 | Mar-20 | May-20 | Jul-20 | May-22 | Jul-22 | Aug-22 | Sept-22 | Nov-22 | May-23 |

| KAS / SBR | 3.25% | 3.25% | 3.00% | 3.25% | 3.25% | 3.00% | 2.75% | 2.50% | 2.00% | 1.75% | 2.00% | 2.25% | 2.25% | 2.50% | 2.75% | 3.00% |

| KA / BR | 4.00% | 3.90% | 3.65% | 3.90% | 4.00% | 3.75% | 3.50% | 3.25% | 2.75% | 2.50% | 2.75% | 3.00% | 3.00% | 3.25% | 3.50% | 3.75% |

| KPA / BLR | 6.85% | 6.85% | 6.60% | 6.95% | 6.95% | 6.70% | 6.45% | 6.20% | 5.70% | 5.45% | 5.70% | 5.95% | 5.95% | 6.20% | 6.45% | 6.70% |

| PKEP / IELR | 4.65% | 4.65% | 5.00% | 5.00% | 4.75% | 4.50% | 4.50% | 4.25% | 3.75% | 3.50% | 3.75% | 4.00% | 4.00% | 4.25% | 4.50% | 4.75% |

Rujukan / Reference:

Kadar Asas Standard (KAS) / Standardised Base Rate (SBR), Kadar Asas (KA) / Base Rate (BR), Kadar Pinjaman Asas (KPA) / Base Lending Rate (BLR), Petunjuk Kadar Efektif Pinjaman (PKEP) / Indicative Effective Lending Rate (IELR)

Catatan:

Note:

Catatan: KASI telah diperkenalkan pada 1 Ogos 2022. Garis putus-putus menunjukkan data OPR yang terdahulu, iaitu kadar penanda aras KASI.

Note: The SBRI was introduced on 1 August 2022. The dotted line shows the historical series of the OPR, which is the benchmark rate of the SBRI.

| Home Financing Current Board Rate | ||

| Financing Amount | Board Rate (p.a.) | Effective Rate (p.a.) |

| < RM100,000 | SBRI + 3.60% | 6.60% |

| RM100,000 - < RM250,000 | SBRI + 3.60% | 6.60% |

| RM250,000 - < RM400,000 | SBRI + 3.30% | 6.30% |

| RM400,000 - < RM600,000 | SBRI + 3.20% |

6.20% |

| RM600,000 - < RM1,000,000 | SBRI + 3.10% | 6.10% |

| RM1,000,000 & above | SBRI + 3.05% | 6.05% |

| Commercial Property Financing-i Current Board Rate | ||

| Financing Amount | Board Rate (p.a.) | Effective Rate (p.a.) |

| <= RM500,000 | SBRI + 2.80% | 5.80% |

| Above RM500,000 | SBRI + 2.50% | 5.50% |

Important Note: Standardised Base Rate Islamic (SBRI) is 3.00% p.a. effective 8 May 2023

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

PIDM Membership Representation

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

We used cookies to improve your experience on our website. By continuing to use our website and/or accepting this message, you agree to our use of cookies. Please refer to our Privacy Policy for more information.